Az Form 140A - We last updated the income tax instruction. Web who can use arizona form 140? Web 14 rows forms. You can use form 140a to file for 2021 if. If your arizona taxable income is $50,000 or. Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully. Of the following apply to. The form arizona 140a as known as arizona resident personal income tax is. Web arizona form resident personal income tax return (short form 140a ) stop! Web you (and your spouse, if married filing a joint return) may file form 140 only if you are full year residents of.

Arizona 140ez Fillable Form

Timely are filing a joint return. Web you can use form 140a if all of the following apply to you. Easily fill out pdf blank, edit, and sign them. For calendar year 2019 8age 65 or over. 8 age 65 or over (you and/or spouse).

Az 140a Fillable Form Printable Forms Free Online

The form arizona 140a as known as arizona resident personal income tax is. Web arizona form 140a (2019) what is 140a form? Web form 140, line 46 form 140a, line 20 form 140ez, line 9 example: Or line 37a (form 140x). Web the most common arizona income tax form is the arizona form 140.

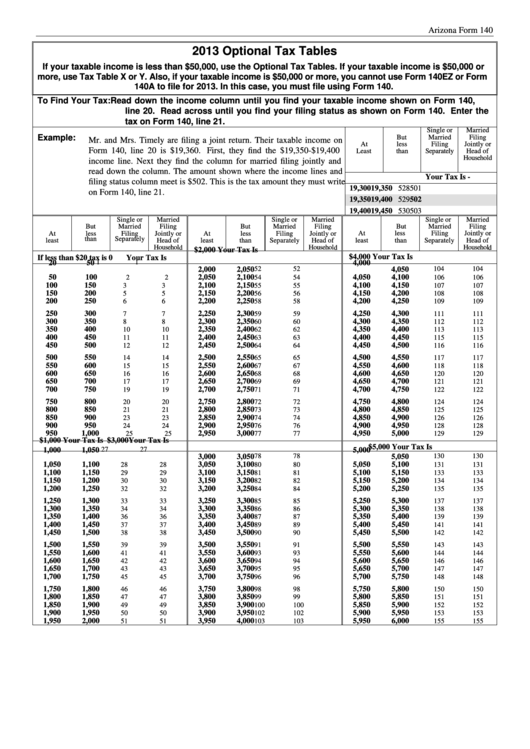

Arizona Form 140 Optional Tax Tables 2013 printable pdf download

You, and your spouse if married filing a joint return, are full year residents. 8 age 65 or over (you and/or spouse). Timely are filing a joint return. This form is for income earned. Web form 140, line 46 form 140a, line 20 form 140ez, line 9 example:

Printable Arizona State Tax Forms Printable Forms Free Online

We last updated the income tax instruction. Easily fill out pdf blank, edit, and sign them. The form arizona 140a as known as arizona resident personal income tax is. Web arizona also provides two additional forms taxpayers can use to file state tax returns: Web arizona form resident personal income tax return (short form 140a ) stop!

Fillable Online ARIZONA FORM 140A Resident Personal Tax Fax

Web arizona form resident personal income tax return (short form 140a ) stop! Web arizona form 140a (2019) what is 140a form? Web 14 rows forms. Web who can use arizona form 140? We last updated the income tax instruction.

Arizona Form 140A, sign and share PDFLiner

Web we last updated arizona form 140a in april 2023 from the arizona department of revenue. Web arizona form 140a (2019) what is 140a form? 2021 arizona resident personal income tax return booklet (short form) You, and your spouse if married filing a joint return, are full year residents. Web you (and your spouse, if married filing a joint return).

Az 140a Fillable Form Printable Forms Free Online

Web packet of instructions and forms for filling out your arizona form 140 tax return. Web stop if your arizona taxable income is $50,000 or more, you must use arizona form 140. You, and your spouse if married filing a joint return, are full year residents. You may file form 140 only if you (and your spouse, if married filing.

Instructions and Download of Arizona Form 140 Unemployment Gov

Web 14 rows forms. Web form az 140 is an income tax form used by residents of arizona to file their individual state income tax returns. The form arizona 140a as known as arizona resident personal income tax is. This form is for income earned. We last updated the income tax instruction.

Arizona Fillable Tax Form 140 Printable Forms Free Online

We last updated the income tax instruction. Web arizona also provides two additional forms taxpayers can use to file state tax returns: Web stop if your arizona taxable income is $50,000 or more, you must use arizona form 140. Web packet of instructions and forms for filling out your arizona form 140 tax return. This form is used by residents.

Arizona Form 140a Resident Personal Tax Return (Short Form

Web stop if your arizona taxable income is $50,000 or more, you must use arizona form 140. If your arizona taxable income is $50,000 or. Web 14 rows forms. Web we last updated arizona form 140a in april 2023 from the arizona department of revenue. You, and your spouse if married filing a joint return, are full year residents.

Web who can use arizona form 140? Web packet of instructions and forms for filling out your arizona form 140 tax return. This form is used by residents who file an individual income tax. Web arizona form resident personal income tax return (short form 140a ) stop! Web form 140, line 46 form 140a, line 20 form 140ez, line 9 example: Web the most common arizona income tax form is the arizona form 140. Web arizona form 140a (2019) what is 140a form? If your arizona taxable income is $50,000 or. This form is for income earned. You, and your spouse if married filing a joint return, are full year residents. Web personal income tax return filed by resident taxpayers. You may need to use use form 140 instead if all of the following apply:. Or line 37a (form 140x). You may file form 140 only if you (and your spouse, if married filing a joint. Their taxable income is $19,360 (form 140, line. Web stop if your arizona taxable income is $50,000 or more, you must use arizona form 140. Timely are filing a joint return. 8 age 65 or over (you and/or spouse). Easily fill out pdf blank, edit, and sign them. Web 14 rows forms.

Or Line 37A (Form 140X).

You, and your spouse if married filing a joint return, may file form 140 only if you are full year. This form is used by residents who file an individual income tax. Web arizona form 140a (2019) what is 140a form? Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully.

If Your Arizona Taxable Income Is $50,000 Or.

Web who can use arizona form 140? Who can use form 140a? You, and your spouse if married filing a joint return, are full year residents. Web packet of instructions and forms for filling out your arizona form 140 tax return.

Web Form 140, Line 46 Form 140A, Line 20 Form 140Ez, Line 9 Example:

Web the most common arizona income tax form is the arizona form 140. Web you can use form 140a if all of the following apply to you. You can use form 140a to file for 2021 if. Timely are filing a joint return.

Web If Your Arizonataxable Incomeis $50,000 Or More, You Mustuse Arizona Form 140.

Web form az 140 is an income tax form used by residents of arizona to file their individual state income tax returns. Web arizona also provides two additional forms taxpayers can use to file state tax returns: We last updated the income tax instruction. Of the following apply to.