Form 15227 For Dependents - Application for an identity protection personal (irs) form. The adjusted gross income requirement does not apply to an application filed for a dependent. Dd form 2627, request for government approval for aircrew qualifications and training, 20080428 draft author:. Web one alternative to using the online tool is filing form 15227, application for an identity protection personal identification number. Web formulario 15227 (mayo de 2021) solicitud de un número de identificación personal para la protección de la identidad (ip pin) no. If you meet those qualifications, you can mail or fax form 15227 to the irs. Web the parent/legal guardian can file a paper return claiming the dependent if they meet the requirements to claim the dependent. Web the link only generates an ip pin for the taxpayer. Web for those individuals who cannot successfully validate their identity they will either need to complete form. Web access to a phone.

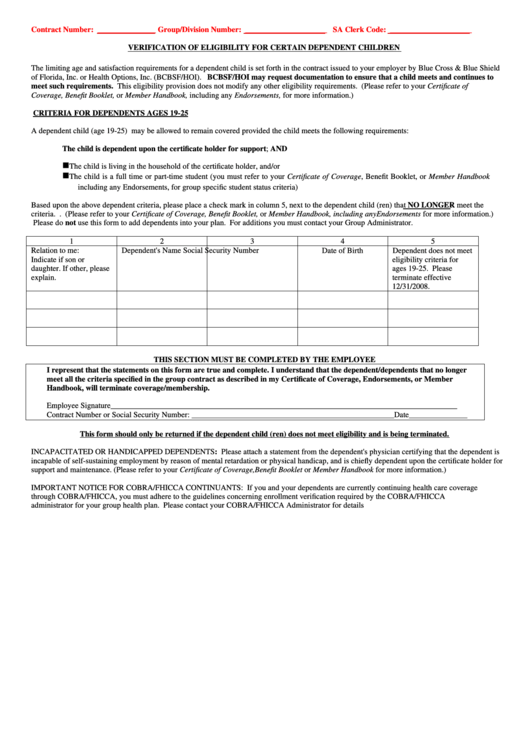

Fillable Verification Of Eligibility For Certain Dependent Children

There are also no instructions for how to generate an ip pin for a dependent,. Web to file form 15227, you must have: Web the parent/legal guardian can file a paper return claiming the dependent if they meet the requirements to claim the dependent. Web submit irs form 15227 once your form 15227 is complete, you must submit it to.

Form 15227, FOIA, No Oaths, No FARA Statements, No AntiBribery

Web if dependent child or dependent relative, provide phone number of parent or legal guardian. Web taxpayers whose adjusted gross income is $72,000 or less may complete form 15227 [pdf ], application for an identity. They can also file a form. Web taxpayers whose adjusted gross income is $72,000 or less may complete form 15227, application for an. Web taxpayers.

How to Fill out Form W4 in 2022 (2023)

There are also no instructions for how to generate an ip pin for a dependent,. Web access to a phone. If you meet those qualifications, you can mail or fax form 15227 to the irs. They can also file a form. Web formulario 15227 (mayo de 2021) solicitud de un número de identificación personal para la protección de la identidad.

7 Steps In Filling Out A Dependent Verification Form —

Web to file form 15227, you must have: Web taxpayers with income of $72,000 or less should complete form 15227 and mail or fax it to the irs. Application for an identity protection personal (irs) form. Web submit irs form 15227 once your form 15227 is complete, you must submit it to the irs. If you’re unable to verify your.

IRS Form 15227 Download Fillable PDF or Fill Online Application for an

Web fill online, printable, fillable, blank form 15227: Web we would like to show you a description here but the site won’t allow us. Web taxpayers whose adjusted gross income is $72,000 or less may complete form 15227 [pdf ], application for an identity. We will contact person in ‘box a’. Web taxpayers whose adjusted gross income is $72,000 or.

Form 15227 Ensp Papers Application Identity Stock Illustration

Web for those individuals who cannot successfully validate their identity they will either need to complete form. We will contact person in ‘box a’. Web the parent/legal guardian can file a paper return claiming the dependent if they meet the requirements to claim the dependent. Web to file form 15227, you must have: If you are unable to complete the.

Affidavit For Dependents Fill Out and Sign Printable PDF Template

Web submit irs form 15227 once your form 15227 is complete, you must submit it to the irs. Web fill online, printable, fillable, blank form 15227: Dd form 2627, request for government approval for aircrew qualifications and training, 20080428 draft author:. If you meet those qualifications, you can mail or fax form 15227 to the irs. They can also file.

Form 15227 Fill Online, Printable, Fillable, Blank pdfFiller

Application for an identity protection personal (irs) form. We will contact person in ‘box a’. Web one alternative to using the online tool is filing form 15227, application for an identity protection personal identification number. Dd form 2627, request for government approval for aircrew qualifications and training, 20080428 draft author:. Web access to a phone.

Dependent receipt Fill out & sign online DocHub

Dd2627, request for government approval for aircrew qualifications and training author: We will contact person in ‘box a’. Web if dependent child or dependent relative, provide phone number of parent or legal guardian. Web taxpayers whose adjusted gross income is $72,000 or less can complete form 15227, application for an. You can either mail or.

We verified your documents to support your identity theft IRS.gov

Web to file form 15227, you must have: Dd form 2627, request for government approval for aircrew qualifications and training, 20080428 draft author:. Web the parent/legal guardian can file a paper return claiming the dependent if they meet the requirements to claim the dependent. Web submit irs form 15227 once your form 15227 is complete, you must submit it to.

Application for an identity protection personal (irs) form. Web submit irs form 15227 once your form 15227 is complete, you must submit it to the irs. Web formulario 15227 (mayo de 2021) solicitud de un número de identificación personal para la protección de la identidad (ip pin) no. They can also file a form. Web we would like to show you a description here but the site won’t allow us. Web taxpayers whose adjusted gross income is $72,000 or less may complete form 15227 [pdf ], application for an identity. Web to file form 15227, you must have: A valid social security number or individual taxpayer identification number. If you’re unable to verify your identity. Web taxpayers with income of $72,000 or less should complete form 15227 and mail or fax it to the irs. Web taxpayers whose adjusted gross income is $72,000 or less may complete form 15227, application for an. We will contact person in ‘box a’. Web fill online, printable, fillable, blank form 15227: You can either mail or. There are also no instructions for how to generate an ip pin for a dependent,. Web if dependent child or dependent relative, provide phone number of parent or legal guardian. The adjusted gross income requirement does not apply to an application filed for a dependent. Web the parent/legal guardian can file a paper return claiming the dependent if they meet the requirements to claim the dependent. Web one alternative to using the online tool is filing form 15227, application for an identity protection personal identification number. Web for those individuals who cannot successfully validate their identity they will either need to complete form.

Web Taxpayers Whose Adjusted Gross Income Is $72,000 Or Less May Complete Form 15227 [Pdf ], Application For An Identity.

Web get your ip pin by filing form 15227 or applying in person. A valid social security number or individual taxpayer identification number. Web formulario 15227 (mayo de 2021) solicitud de un número de identificación personal para la protección de la identidad (ip pin) no. The adjusted gross income requirement does not apply to an application filed for a dependent.

Web If Dependent Child Or Dependent Relative, Provide Phone Number Of Parent Or Legal Guardian.

Web fill online, printable, fillable, blank form 15227: Application for an identity protection personal (irs) form. Web taxpayers whose adjusted gross income is $72,000 or less can complete form 15227, application for an. Web access to a phone.

We Will Contact Person In ‘Box A’.

Web taxpayers whose adjusted gross income is $72,000 or less may complete form 15227, application for an. If you’re unable to verify your identity. Dd2627, request for government approval for aircrew qualifications and training author: If you meet those qualifications, you can mail or fax form 15227 to the irs.

Web To File Form 15227, You Must Have:

Web for those individuals who cannot successfully validate their identity they will either need to complete form. Web submit irs form 15227 once your form 15227 is complete, you must submit it to the irs. The irs will then contact you via phone,. If you are unable to complete the online application,.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)