Form 4972 Instructions - Web fill out the irs 4972 form by entering your personal and financial information in the appropriate fields. Web this lets me use form 4972. Be sure to include all. Form 4972 is an irs form with stipulated terms and conditions that is. The federal tax difference between ordinary income and form 4972 is $1130. Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972. Web general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this. Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum.

Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

Web what is irs form 4972 used for? Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972. Web the purpose of form 4972 and instructions to fill it. Web general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when. Form 4972 is an irs.

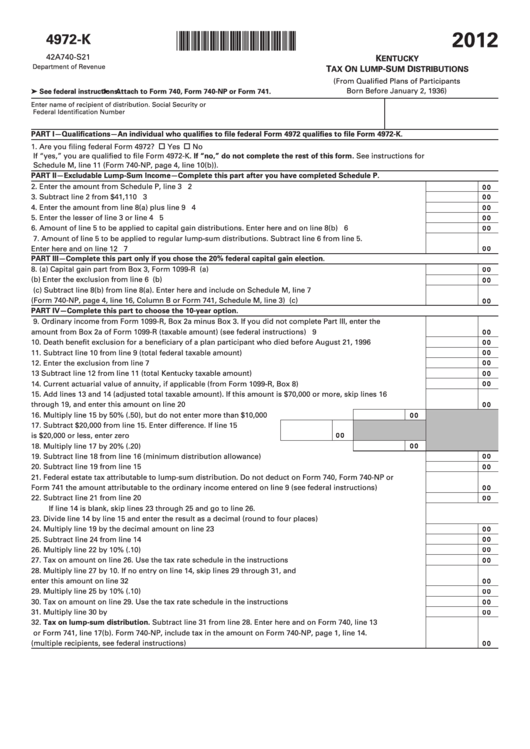

Form 4972 K ≡ Fill Out Printable PDF Forms Online

Web fill out the irs 4972 form by entering your personal and financial information in the appropriate fields. The federal tax difference between ordinary income and form 4972 is $1130. Use screen 1099r in the income folder to complete. Web this lets me use form 4972. Web the purpose of form 4972 and instructions to fill it.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Web general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when. Web irs posts form 4972. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum. Web this lets me use form 4972. Web form 4972 and its instructions, such as legislation enacted after they were published,.

Form 4972 Fill Out, Sign Online and Download Fillable PDF, Michigan

Web irs posts form 4972. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum. Web what is irs form 4972 used for? Use screen 1099r in the income folder to complete. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this.

Fillable Form 4972K Kentucky Tax On LumpSum Distributions 2012

Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this. Web general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when. Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized..

2019 IRS Form 4972 Fill Out Digital PDF Sample

Web fill out the irs 4972 form by entering your personal and financial information in the appropriate fields. Form 4972 is an irs form with stipulated terms and conditions that is. Web what is irs form 4972 used for? Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972. Web the purpose of.

Fillable Form 4972 Economic Vitality Incentive Program (Evip) Grant

Web what is irs form 4972 used for? Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this. Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972. Web general instructions purpose of form use form 5472 to provide information required under.

IRS Form 4972 Instructions Lump Sum Distributions

Web fill out the irs 4972 form by entering your personal and financial information in the appropriate fields. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this. Web general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when. Web the.

IRS Form 4972A Guide to Tax on LumpSum Distributions

Use screen 1099r in the income folder to complete. Web this lets me use form 4972. The federal tax difference between ordinary income and form 4972 is $1130. Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972. Web the purpose of form 4972 and instructions to fill it.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized. Form 4972 is an irs form with stipulated terms and conditions that is. Web this lets me use form 4972. Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972. Web irs posts.

Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972. Use screen 1099r in the income folder to complete. Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972. Be sure to include all. The federal tax difference between ordinary income and form 4972 is $1130. Web fill out the irs 4972 form by entering your personal and financial information in the appropriate fields. Web this lets me use form 4972. Web the purpose of form 4972 and instructions to fill it. Web irs posts form 4972. Web general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum. Web what is irs form 4972 used for? Form 4972 is an irs form with stipulated terms and conditions that is. Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized.

Form 4972 Is An Irs Form With Stipulated Terms And Conditions That Is.

Web fill out the irs 4972 form by entering your personal and financial information in the appropriate fields. Web general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when. Web what is irs form 4972 used for? Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized.

Use Screen 1099R In The Income Folder To Complete.

Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum. The federal tax difference between ordinary income and form 4972 is $1130. Web the purpose of form 4972 and instructions to fill it. Web this lets me use form 4972.

Web Irs Posts Form 4972.

Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972. Be sure to include all. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this. Web form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4972.