Form 5227 Instructions - If the due date falls on a saturday, sunday, or legal holiday, the organization. Web go to screen 48.1, form 5227. His office is conveniently located in jacksonville, fl, an area with a. Scroll down to part vi charitable remainder unitrusts section. Web the following rules and worksheets will help you figure the type of income a recipient receives from the trust's distributions. Web ment form may state that there have been no changes since the last update and that the current information is correct.) when. Social services (dss) form effective date: Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return),. Web form 5227 instructionsstate that the following types of organizations should use form 5227: For instructions and the latest information.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

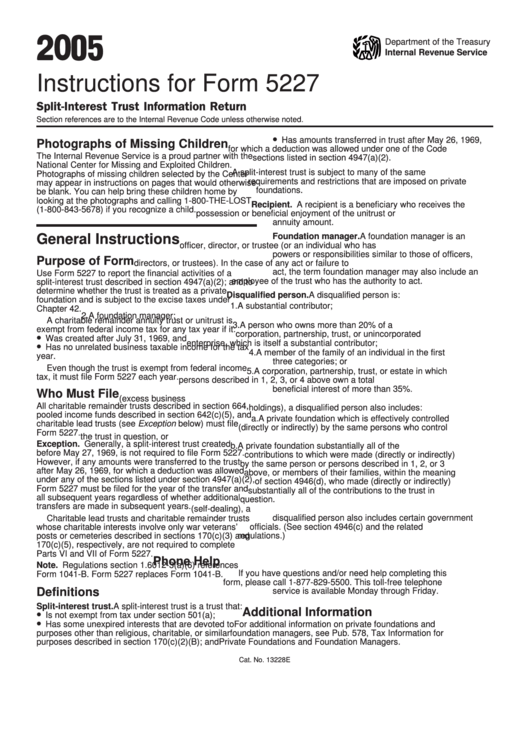

Web go to screen 48.1, form 5227. Department of the treasury internal revenue service. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your. Web form 5227 is due by april 15 of each year. Web general instructions for certain information returns.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return),. Web the requirements of section 6034 and continues to meet form 5227 is open to public inspection. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. On form 8027, you must report your establishment’s gross. Enter.

Instructions for Form 5227 IRS Fill Out and Sign Printable PDF

Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. Web the requirements of section 6034 and continues to meet form 5227 is open to public inspection. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your. Web he handles military.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return),. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. For instructions and the latest information. Web go to screen 48.1, form 5227. Enter 1 in 1= required.

Instructions For Form 5227 printable pdf download

Web video instructions and help with filling out and completing 5227 irs form. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your. Web the following rules and worksheets will help you figure the type of income a recipient receives from the trust's distributions. Web general instructions for.

Form 5227 Split Interest Trust Information Return Instructions and

Web the following rules and worksheets will help you figure the type of income a recipient receives from the trust's distributions. Web ment form may state that there have been no changes since the last update and that the current information is correct.) when. Web go to screen 48.1, form 5227. For instructions and the latest information. Web form 5227.

Download Instructions for IRS Form 5227 SplitInterest Trust

Social services (dss) form effective date: Web he handles military personal injury cases throughout florida. Web general instructions for certain information returns. Web the requirements of section 6034 and continues to meet form 5227 is open to public inspection. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for.

Instructions For Form 5227 printable pdf download

Web form 5227 instructionsstate that the following types of organizations should use form 5227: For instructions and the latest information. Web the requirements of section 6034 and continues to meet form 5227 is open to public inspection. Web ment form may state that there have been no changes since the last update and that the current information is correct.) when..

Fillable Online 2022 Instructions for Form 5227 Fax Email Print pdfFiller

Web video instructions and help with filling out and completing 5227 irs form. Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return),. Web go to screen 48.1, form 5227. Web form 5227 is due by april 15 of each year. Department of the treasury internal revenue service.

Instructions For Form 5227 printable pdf download

Web go to screen 48.1, form 5227. Web form 5227 is due by april 15 of each year. On form 8027, you must report your establishment’s gross. Web ment form may state that there have been no changes since the last update and that the current information is correct.) when. If the due date falls on a saturday, sunday, or.

Scroll down to part vi charitable remainder unitrusts section. Social services (dss) form effective date: Web go to screen 48.1, form 5227. If the due date falls on a saturday, sunday, or legal holiday, the organization. Department of the treasury internal revenue service. For instructions and the latest information. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your. Web ment form may state that there have been no changes since the last update and that the current information is correct.) when. Web general instructions for certain information returns. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return),. Web the following rules and worksheets will help you figure the type of income a recipient receives from the trust's distributions. Web the requirements of section 6034 and continues to meet form 5227 is open to public inspection. Web form 5227 is due by april 15 of each year. His office is conveniently located in jacksonville, fl, an area with a. Web form 5227 instructionsstate that the following types of organizations should use form 5227: Enter 1 in 1= required. Web video instructions and help with filling out and completing 5227 irs form. Web he handles military personal injury cases throughout florida. On form 8027, you must report your establishment’s gross.

Web Video Instructions And Help With Filling Out And Completing 5227 Irs Form.

Web form 5227 instructionsstate that the following types of organizations should use form 5227: Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return),. Web ment form may state that there have been no changes since the last update and that the current information is correct.) when. Web he handles military personal injury cases throughout florida.

Web Form 5227 Is Due By April 15 Of Each Year.

Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your. Web general instructions for certain information returns. Scroll down to part vi charitable remainder unitrusts section.

Web The Following Rules And Worksheets Will Help You Figure The Type Of Income A Recipient Receives From The Trust's Distributions.

Web the requirements of section 6034 and continues to meet form 5227 is open to public inspection. Web go to screen 48.1, form 5227. Department of the treasury internal revenue service. If the due date falls on a saturday, sunday, or legal holiday, the organization.

On Form 8027, You Must Report Your Establishment’s Gross.

His office is conveniently located in jacksonville, fl, an area with a. Social services (dss) form effective date: For instructions and the latest information. Enter 1 in 1= required.