Form 8804 Instructions - Web form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section. Web solved•by intuit•30•updated may 23, 2023. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web understanding form 8804. Web the irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Form ftb 3804 also includes a. Web section 1445(a) or 1445(e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the. Web for filing form 8804, you’ll need to gather specific information, supporting documentation, and attachments to. 1446 requires that a partnership withhold income tax from a foreign partner (as defined in sec. Web use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income.

Instructions For Form 8804W Installment Payments Of Section 1446 Tax

Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Source effectively connected income, it may be required to file form 8804 & 8805 if. Web check the “federal extension” box at the top of the form if you filed for an extension to file federal form 8804, annual return for. Web.

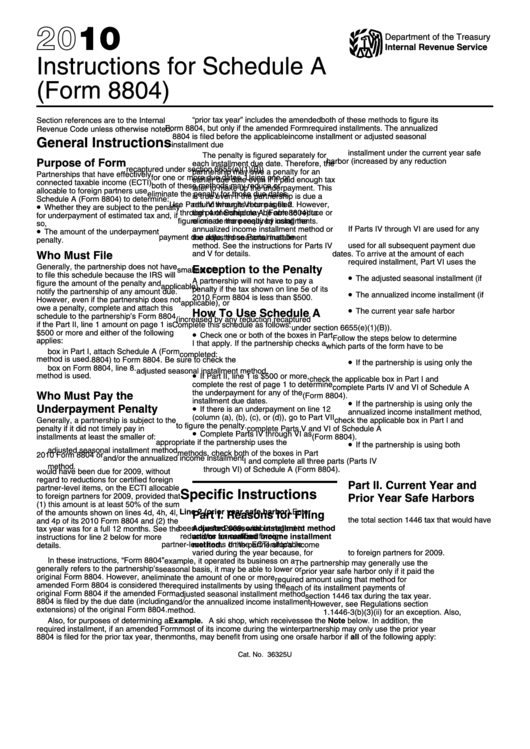

Instructions For Schedule A (Form 8804) 2008 printable pdf download

Web section 1445(a) or 1445(e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the. Web form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section. Web check the “federal extension” box at the top of the form if you filed for an extension to file federal form.

Form 8804 Instructions for Foreign Partner Withholding

Web section 1445(a) or 1445(e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the. Form ftb 3804 also includes a. Web solved•by intuit•30•updated may 23, 2023. Web form 8804 is also a transmittal form for form(s) 8805. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified.

Download Instructions for IRS Form 8804, 8805, 8813 PDF, 2020

Web section 1445(a) or 1445(e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the. Web understanding form 8804. Web the irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s.

Form 8804W Installment Payments of Section 1446 Tax for Partnership…

A foreign partner must partnership at any time. Web solved•by intuit•30•updated may 23, 2023. Source effectively connected income, it may be required to file form 8804 & 8805 if. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related. Use form 8805 to show the amount of ecti and the total tax credit.

Download Instructions for IRS Form 8804, 8805, 8813 PDF Templateroller

Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related. Web section 1445(a) or 1445(e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the. Web for filing form.

Instructions For Schedule A (Form 8804) 2010 printable pdf download

Web use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income. If you need more time, you may file form 2758, application for extension of time to file certain excise, income,. Web understanding form 8804. November 2022) annual return for partnership withholding tax (section 1446) department of the. Web form.

Form 8804 Annual Return for Partnership Withholding Tax

Web form 8804 is also a transmittal form for form(s) 8805. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web section 1445(a) or 1445(e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the. Web form 8804, annual return for partnership withholding tax (section.

Instructions For Schedule A (Form 8804) 2011 printable pdf download

Web section 1445(a) or 1445(e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the. Form 8804, known as the annual return for partnership withholding tax, is akin to an. Web for filing form 8804, you’ll need to gather specific information, supporting documentation, and attachments to. Web the irs supports electronic filing only for.

Form 8804 Schedule A Instructions Fill online, Printable, Fillable Blank

Form 8804 is an annual summary statement of any forms 8805 that were sent to foreign partners. Web section 1445(a) or 1445(e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the. A foreign partner must partnership at any time. Use form 8805 to show the amount of ecti and the total tax credit..

Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. If you need more time, you may file form 2758, application for extension of time to file certain excise, income,. Web form 8804 is also a transmittal form for form(s) 8805. Web a form 8805 for each foreign partner must be attached to form 8804, whether or not any withholding tax was paid. Web check the “federal extension” box at the top of the form if you filed for an extension to file federal form 8804, annual return for. Web what is form 8804? This article will help you generate and file forms 8804, annual. Form ftb 3804 also includes a. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related. Web when a partnership earns u.s. A foreign partner must partnership at any time. Web the irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Source effectively connected income, it may be required to file form 8804 & 8805 if. Web section 1445(a) or 1445(e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the. Web for filing form 8804, you’ll need to gather specific information, supporting documentation, and attachments to. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Form 8804, known as the annual return for partnership withholding tax, is akin to an. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total. Web solved•by intuit•30•updated may 23, 2023. November 2022) annual return for partnership withholding tax (section 1446) department of the.

Web Understanding Form 8804.

Source effectively connected income, it may be required to file form 8804 & 8805 if. November 2022) annual return for partnership withholding tax (section 1446) department of the. Web form 8804 is also a transmittal form for form(s) 8805. Web section 1445(a) or 1445(e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the.

Web Form 8804 Department Of The Treasury Internal Revenue Service Annual Return For Partnership Withholding Tax (Section.

If you need more time, you may file form 2758, application for extension of time to file certain excise, income,. Web a form 8805 for each foreign partner must be attached to form 8804, whether or not any withholding tax was paid. Web for filing form 8804, you’ll need to gather specific information, supporting documentation, and attachments to. Web the irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004.

Web Use Form Ftb 3804 To Report The Elective Tax On The Electing Qualified Pte’s Qualified Net Income.

Web use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income. Use form 8805 to show the amount of ecti and the total tax credit. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related. Web what is form 8804?

Form 8804, Known As The Annual Return For Partnership Withholding Tax, Is Akin To An.

Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. Web solved•by intuit•30•updated may 23, 2023. Web check the “federal extension” box at the top of the form if you filed for an extension to file federal form 8804, annual return for. Form ftb 3804 also includes a.