Fulton County Tax Appeal Form - You will get a letter in the mail responding. Web appeals may be submitted online at www.fultonassessor.org, by mail, or in the offices of the board of assessors. The county could drop your. The supreme court ruling on tads. The notice of appeal shall be filed. Check all that apply exemption denied breach of covenant. To ensure the preservation of your. Web the written appeal is filed initially with the board of tax assessors. Web the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Web you may only submit them to the state after you have gone through the fulton county board of review.

Atlanta Property Tax Calculator Fulton County. Millage Rate

Web superior court the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Web the written appeal is filed initially with the board of tax assessors. Web tax allocation districts in fulton county. Web the fulton county tax commissioner is responsible for the collection of property taxes for fulton county government,. The supreme.

Part 2 how to appeal your property taxes Michelle Hatch Realtor

Web specify grounds for appeal: Web superior court the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Web the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Web appeals may be submitted online at www.fultonassessor.org, by mail, or in the offices of the board.

Fulton County Tax Appeal Forms

The supreme court ruling on tads. Welcome to the fulton county smartfile site. Web onsite paperless filing onsite paperless filing is now available for your convenience at all our homestead locations. File an appeal on the fulton county board of assessors website. Web the written appeal is filed initially with the board of tax assessors.

HB 202 Fulton County Tax Assessors and Its Final Valuation During

Web appealing your assessment boards of equalization homestead exemptions boards of equalization 141 pryor street, s.w.,. Homestead & special exemptions real property returns (jan. Web appeals may be submitted online at www.fultonassessor.org, by mail, or in the offices of the board of assessors. Web the fulton county tax commissioner is responsible for the collection of property taxes for fulton county.

Fill Free fillable forms Fulton County Government

Web the appellant or the county board of tax assessors may appeal decisions of the board of equalization. You will get a letter in the mail responding. The notice of appeal shall be filed. Web you may only submit them to the state after you have gone through the fulton county board of review. Web in the initial written dispute,.

Fillable Dte Form 4 Notice Of Appeal To The Board Of Tax Appeals

Web appeals may be submitted online at www.fultonassessor.org, by mail, or in the offices of the board of assessors. The appeals deadline for most. Web the fulton county tax commissioner is responsible for the collection of property taxes for fulton county government,. Homestead & special exemptions real property returns (jan. Web appeal of assessment form the state of georgia provides.

Fill Free fillable forms Fulton County Government

Web specify grounds for appeal: Web step 1 of 5 assessing your home you will only be able to appeal the assessed value of your home, not your property’s. The notice of appeal shall be filed. Web onsite paperless filing onsite paperless filing is now available for your convenience at all our homestead locations. Web the written appeal is filed.

Fulton County Property Tax Online Payment Property Walls

The supreme court ruling on tads. You will get a letter in the mail responding. Web superior court the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Web this printable was uploaded at august 30, 2023 by tamble in tax. Check all that apply exemption denied breach of covenant.

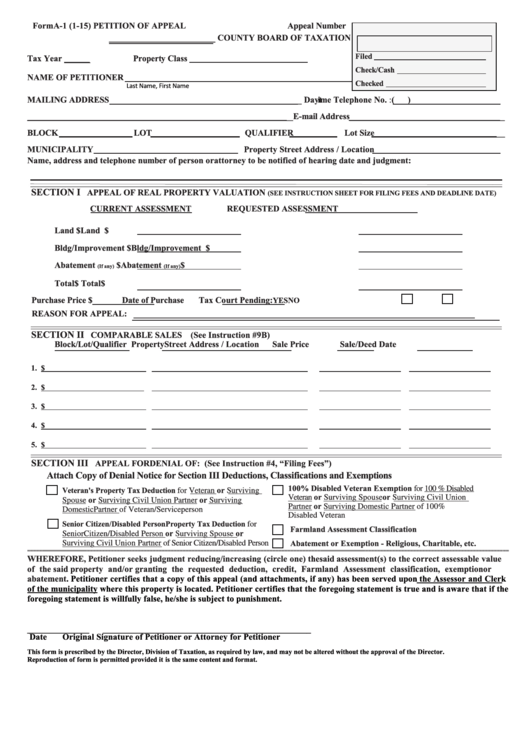

Fillable Form A1 Petition Of Appeal County Board Of Taxation 2015

The appeals deadline for most. Web in the initial written dispute, property owners must indicate their preferred method of appeal. Web the fulton county tax commissioner is responsible for the collection of property taxes for fulton county government,. The supreme court ruling on tads. Web superior court the appellant or the county board of tax assessors may appeal decisions of.

Fulton County Tax Assessment Appeals Process Explained

The notice of appeal shall be filed. Web superior court the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Welcome to the fulton county smartfile site. Web specify grounds for appeal: Web you may only submit them to the state after you have gone through the fulton county board of review.

The county could drop your. Web the fulton county tax commissioner is responsible for the collection of property taxes for fulton county government,. Web tax allocation districts in fulton county. Web you may only submit them to the state after you have gone through the fulton county board of review. Web the appellant or the county board of tax assessors may appeal decisions of the board of equalization. The appeals deadline for most. File an appeal on the fulton county board of assessors website. Ending tax on tags would be fairer to all. Welcome to the fulton county smartfile site. The notice of appeal shall be filed. Web superior court the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Web onsite paperless filing onsite paperless filing is now available for your convenience at all our homestead locations. Homestead & special exemptions real property returns (jan. Web appealing your assessment boards of equalization homestead exemptions boards of equalization 141 pryor street, s.w.,. You may appeal your annual notice of assessment by using one of the methods below and you must do so by. Web the written appeal is filed initially with the board of tax assessors. The supreme court ruling on tads. Web appeals may be submitted online at www.fultonassessor.org, by mail, or in the offices of the board of assessors. You will get a letter in the mail responding. To ensure the preservation of your.

Web In The Initial Written Dispute, Property Owners Must Indicate Their Preferred Method Of Appeal.

You may appeal your annual notice of assessment by using one of the methods below and you must do so by. The notice of appeal shall be filed. The county could drop your. The supreme court ruling on tads.

File An Appeal On The Fulton County Board Of Assessors Website.

Web step 1 of 5 assessing your home you will only be able to appeal the assessed value of your home, not your property’s. Web appealing your assessment boards of equalization homestead exemptions boards of equalization 141 pryor street, s.w.,. The appeals deadline for most. Web superior court the appellant or the county board of tax assessors may appeal decisions of the board of equalization.

Welcome To The Fulton County Smartfile Site.

Web this printable was uploaded at august 30, 2023 by tamble in tax. Web appeal of assessment form the state of georgia provides a uniform appeal form for use by property owners. Web onsite paperless filing onsite paperless filing is now available for your convenience at all our homestead locations. All parcels in appeal will be billed at 85% of the assessed value.

Web Tax Allocation Districts In Fulton County.

Web specify grounds for appeal: Web the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Ending tax on tags would be fairer to all. Web the written appeal is filed initially with the board of tax assessors.