Indiana Withholding Form - How to compute withholding for state and county income tax. For example, the renter’s deduction in indiana reduces the. Do not send this form. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web deductions reduce the amount of your income that is taxable. Web exemption from withholding if you do not expect to owe any iowa income tax and have a right to a full refund of all income tax. October 16, 2023 larry the payroll guy. Web employee’s withholding exemption and county status certificate. Web enter an amount of state tax that you wish to have withheld from each check. Otherwise, skip to step 5.

State Of Indiana Tax Withholding Forms

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web enter an amount of state tax that you wish to have withheld from each check. (a) this section applies to: The employer is required to have each employee that. How to compute withholding for state and county income tax.

Fillable Form Wh18 Indiana Miscellaneous Withholding Tax Statement

How to compute withholding for state and county income tax. This form is for the employer’s records. For example, the renter’s deduction in indiana reduces the. Web indiana county income tax increases. (a) this section applies to:

Indiana Employee State Withholding Form

How to compute withholding for state and county income tax. (a) this section applies to: Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web indiana county income tax increases. Web deductions reduce the amount of your income that is taxable.

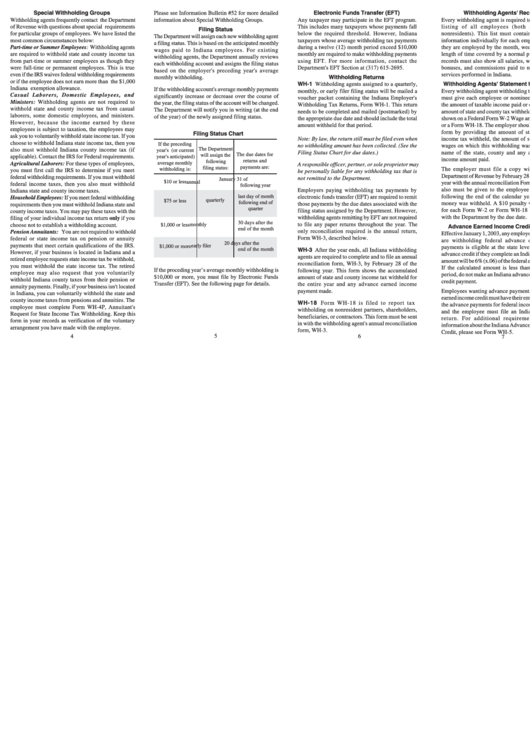

Form Wh13 Withholding Instructions For Indiana State And County

Web exemption from withholding if you do not expect to owe any iowa income tax and have a right to a full refund of all income tax. Web deductions reduce the amount of your income that is taxable. Web page last reviewed or updated: The employer is required to have each employee that. Do not send this form.

Indiana Withholding For Support Form

Web enter an amount of state tax that you wish to have withheld from each check. Web ohio it 4 is an ohio employee withholding exemption certificate. Web deductions reduce the amount of your income that is taxable. Otherwise, skip to step 5. Web indiana county income tax increases.

Employee's Withholding Exemption and County Status Certificate

Otherwise, skip to step 5. The employer is required to have each employee that. Web enter an amount of state tax that you wish to have withheld from each check. Web deductions reduce the amount of your income that is taxable. Web page last reviewed or updated:

Top 13 Indiana Withholding Form Templates free to download in PDF format

This form is for the employer’s records. Web enter an amount of state tax that you wish to have withheld from each check. October 16, 2023 larry the payroll guy. Web deductions reduce the amount of your income that is taxable. The employer is required to have each employee that.

Indiana Tax Withholding Form

This form is for the employer’s records. Do not send this form. (a) this section applies to: For example, the renter’s deduction in indiana reduces the. Otherwise, skip to step 5.

Form Wh1 Withholding Tax printable pdf download

Web enter an amount of state tax that you wish to have withheld from each check. How to compute withholding for state and county income tax. Web deductions reduce the amount of your income that is taxable. (a) this section applies to: The employer is required to have each employee that.

Indiana State Tax Withholding Form Wh4p

Do not send this form. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. If too little is withheld, you. October 16, 2023 larry the payroll guy. The employer is required to have each employee that.

Web enter an amount of state tax that you wish to have withheld from each check. Web indiana county income tax increases. How to compute withholding for state and county income tax. Web page last reviewed or updated: Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web ohio it 4 is an ohio employee withholding exemption certificate. Web employee’s withholding exemption and county status certificate. This form is for the employer’s records. If too little is withheld, you. October 16, 2023 larry the payroll guy. (a) this section applies to: Web exemption from withholding if you do not expect to owe any iowa income tax and have a right to a full refund of all income tax. For example, the renter’s deduction in indiana reduces the. Otherwise, skip to step 5. Web deductions reduce the amount of your income that is taxable. The employer is required to have each employee that. Do not send this form. Web what is backup withholding, later.

Web Page Last Reviewed Or Updated:

This form is for the employer’s records. Web what is backup withholding, later. The employer is required to have each employee that. For example, the renter’s deduction in indiana reduces the.

Web Deductions Reduce The Amount Of Your Income That Is Taxable.

Web enter an amount of state tax that you wish to have withheld from each check. Otherwise, skip to step 5. Web ohio it 4 is an ohio employee withholding exemption certificate. Web exemption from withholding if you do not expect to owe any iowa income tax and have a right to a full refund of all income tax.

Web Employee’s Withholding Exemption And County Status Certificate.

Do not send this form. October 16, 2023 larry the payroll guy. (a) this section applies to: Web indiana county income tax increases.

How To Compute Withholding For State And County Income Tax.

If too little is withheld, you. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or.