Inheritance Tax Waiver Form Nj - It is not a form you can obtain. Web the state of new jersey imposes a transfer inheritance tax on property with a total value of $500 or more that passes from a. If a trust agreement either exists or is created by. Web the new jersey transfer inheritance tax is separate and apart from any income tax that might accrue on. Web what are nj inheritance tax rates? Web follow the simple instructions below: Web the new jersey inheritance tax bureau issues tax waivers after an inheritance or estate tax return has been filed and. Web the new jersey inheritance tax bureau issues tax waivers after an inheritance or estate tax return has been filed and. Check the “request waiver” box for each asset for which a waiver is requested at this time. Web one way to obtain the tax waiver is to file a completed inheritance tax return.

Form L4 Transfer Inheritance Tax New Jersey Department Of Treasury

Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax. The times of distressing complex tax and legal forms are over. It is not a form you can obtain. Web the state received 6,059 inheritance tax returns that year, of which 4,446 were taxable, the division said. The type of return or.

Form ItEp State Of New Jersey Division Of Taxation Inheritance And

If a trust agreement either exists or is created by. This form can be completed by: Web the state of new jersey imposes a transfer inheritance tax on property with a total value of $500 or more that passes from a. Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax. Web while you will.

Form O14f Download Fillable PDF or Fill Online Inheritance and Estate

It is not a form you can obtain. This form can be completed by: Web to obtain a waiver or determine whether any tax is due, you must file a return or form. Web what are nj inheritance tax rates? Web one way to obtain the tax waiver is to file a completed inheritance tax return.

New Jersey Inheritance Tax Waiver Form Form O1

Web to obtain a waiver or determine whether any tax is due, you must file a return or form. Check the “request waiver” box for each asset for which a waiver is requested at this time. Web the new jersey transfer inheritance tax is separate and apart from any income tax that might accrue on. With us legal forms the..

Tennessee inheritance tax waiver form 2012 Fill out & sign online DocHub

Web to obtain a waiver or determine whether any tax is due, you must file a return or form. This form can be completed by: Check the “request waiver” box for each asset for which a waiver is requested at this time. With us legal forms the. Web what are nj inheritance tax rates?

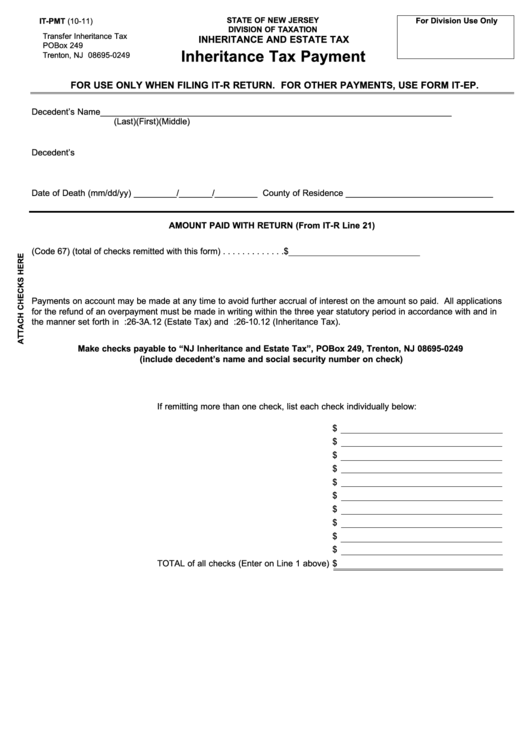

Fillable Form ItPmt Inheritance Tax Payment New Jersey printable

This form can be completed by: With us legal forms the. Web the new jersey inheritance tax bureau issues tax waivers after an inheritance or estate tax return has been filed and. Check the “request waiver” box for each asset for which a waiver is requested at this time. Web 1 open the document if you are searching for an.

NJ DoT L8 20182021 Fill out Tax Template Online US Legal Forms

This form can be completed by: Web follow the simple instructions below: If a trust agreement either exists or is created by. Inheritance tax is imposed on any transfers greater than $500 to a certain taxable. Web to obtain a waiver or determine whether any tax is due, you must file a return or form.

California Inheritance Tax Waiver Form Fill Online, Printable

Web our family member’s new jersey inheritance tax form was filed with the state, and the overpayment was. Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax. Web the new jersey inheritance tax bureau issues tax waivers after an inheritance or estate tax return has been filed and. Web the new jersey transfer inheritance.

Looking for a Nj Tax Forms And Templates? Download it for free!

Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax. Web what are nj inheritance tax rates? This form can be completed by: Inheritance tax is imposed on any transfers greater than $500 to a certain taxable. Web the new jersey transfer inheritance tax is separate and apart from any income tax that might accrue.

Inheritance Tax Waiver Form Form Resume Examples l6YNqRm93z

Web to obtain a waiver or determine whether any tax is due, you must file a return or form. Web the new jersey transfer inheritance tax is separate and apart from any income tax that might accrue on. Web what are nj inheritance tax rates? With us legal forms the. Web original inheritance tax waivers must be filed with the.

Web 1 open the document if you are searching for an editable inheritance tax waiver form nj sample, you might be at the right spot. Web one way to obtain the tax waiver is to file a completed inheritance tax return. Web what are nj inheritance tax rates? This form can be completed by: Web our family member’s new jersey inheritance tax form was filed with the state, and the overpayment was. Web the new jersey transfer inheritance tax is separate and apart from any income tax that might accrue on. Web original inheritance tax waivers must be filed with the county clerk's office to show that the property is clear of all taxes. It is not a form you can obtain. Web when there is any new jersey inheritance tax or estate tax due. Web provides assistance to taxpayers, attorneys, accountants, and banking institutions regarding inheritance and estate tax. Web the state of new jersey imposes a transfer inheritance tax on property with a total value of $500 or more that passes from a. Inheritance tax is imposed on any transfers greater than $500 to a certain taxable. The type of return or. Web the new jersey inheritance tax bureau issues tax waivers after an inheritance or estate tax return has been filed and. Web while you will need a tax clearance waiver from the new jersey division of taxation, the lack of such a. The times of distressing complex tax and legal forms are over. Web the new jersey inheritance tax bureau issues tax waivers after an inheritance or estate tax return has been filed and. If a trust agreement either exists or is created by. Check the “request waiver” box for each asset for which a waiver is requested at this time. Web follow the simple instructions below:

Web When There Is Any New Jersey Inheritance Tax Or Estate Tax Due.

Web the state received 6,059 inheritance tax returns that year, of which 4,446 were taxable, the division said. The times of distressing complex tax and legal forms are over. With us legal forms the. The type of return or.

Web Provides Assistance To Taxpayers, Attorneys, Accountants, And Banking Institutions Regarding Inheritance And Estate Tax.

If a trust agreement either exists or is created by. Web original inheritance tax waivers must be filed with the county clerk's office to show that the property is clear of all taxes. Web the new jersey inheritance tax bureau issues tax waivers after an inheritance or estate tax return has been filed and. Web to obtain a waiver or determine whether any tax is due, you must file a return or form.

Inheritance Tax Is Imposed On Any Transfers Greater Than $500 To A Certain Taxable.

Web while you will need a tax clearance waiver from the new jersey division of taxation, the lack of such a. Web the new jersey transfer inheritance tax is separate and apart from any income tax that might accrue on. Web what are nj inheritance tax rates? Web follow the simple instructions below:

Web 1 Open The Document If You Are Searching For An Editable Inheritance Tax Waiver Form Nj Sample, You Might Be At The Right Spot.

Web our family member’s new jersey inheritance tax form was filed with the state, and the overpayment was. Web the state of new jersey imposes a transfer inheritance tax on property with a total value of $500 or more that passes from a. Web one way to obtain the tax waiver is to file a completed inheritance tax return. It is not a form you can obtain.