Ks Income Tax Forms - Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Individual income tax supplemental schedule. Web kansas has a state income tax that ranges between 3.1% and 5.7%, which is administered by the kansas department of. Current ks tax year tax forms you can efile. Web kansas has a state income tax that ranges between 3.1% and 5.7%. Web the kansas tax forms are listed by tax year below and all ks back taxes for previous years would have to be mailed in. 2022 income tax that was actually paid to the other state (including political subdivisions thereof): Web your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. File your state taxes online; Individual income tax kansas itemized deductions.

Printable Kansas Tax Forms Printable Forms Free Online

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds. Individual income tax supplemental schedule. File your state taxes online; Web kansas income tax forms.

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Web kansas has a state income tax that ranges between 3.1% and 5.7%. Individual income tax kansas itemized deductions. Web kansas has a state income tax that ranges between 3.1% and 5.7%, which is administered by the kansas department of. File your state taxes online; Individual income tax supplemental schedule.

Fillable Form K40pt Kansas Property Tax Relief Claim For Low

If you make $70,000 a year living in kansas you. File your state taxes online; A printer (if you want to print. Individual income tax supplemental schedule. Individual income tax kansas itemized deductions.

Kansas Schedule S Form Fill Out and Sign Printable PDF Template signNow

Web kansas has a state income tax that ranges between 3.1% and 5.7%, which is administered by the kansas department of. Current ks tax year tax forms you can efile. Web your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. A printer (if you want to print. Web.

Fillable Form K40 Kansas Individual Tax Return 2015

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax. 2022 income tax that was actually paid to the other state (including political subdivisions thereof): Web kansas income tax forms. If you make $70,000 a year living in kansas you. A printer (if you want to print.

Form K120 Kansas Corporation Tax 2004 printable pdf download

2022 income tax that was actually paid to the other state (including political subdivisions thereof): Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web died during this tax year, mark an “x” in this box. If you make $70,000 a year living in kansas you. Web these.

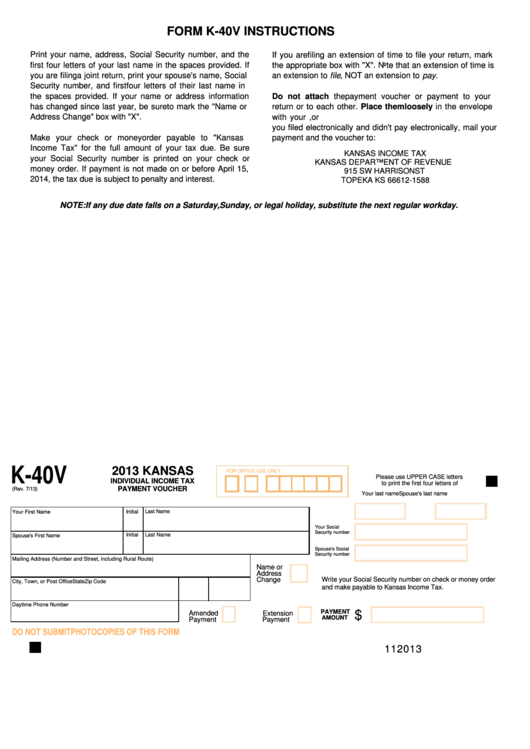

Fillable Form K40v Kansas Individual Tax Payment Voucher

Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds. Web kansas has a state income tax that ranges between 3.1% and 5.7%. Web your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. 1) you.

Form K120 Kansas Corporation Tax 2010 printable pdf download

2022 income tax that was actually paid to the other state (including political subdivisions thereof): Individual income tax supplemental schedule. Individual income tax kansas itemized deductions. Previous tax year or kansas income back taxes forms. Web kansas has a state income tax that ranges between 3.1% and 5.7%, which is administered by the kansas department of.

Fillable Form K120es Kansas Corporate Estimated Tax Voucher

Web the kansas tax forms are listed by tax year below and all ks back taxes for previous years would have to be mailed in. Web a completed 2021 federal income tax return, if you are required to file; A printer (if you want to print. Current ks tax year tax forms you can efile. If you make $70,000 a.

Form K130ES Download Fillable PDF or Fill Online Privilege Estimated

2022 income tax that was actually paid to the other state (including political subdivisions thereof): A printer (if you want to print. Web died during this tax year, mark an “x” in this box. Web the kansas tax forms are listed by tax year below and all ks back taxes for previous years would have to be mailed in. Previous.

Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds. If you make $70,000 a year living in kansas you. Web printable kansas state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31,. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax. Web kansas income tax forms. File your state taxes online; Web kansas has a state income tax that ranges between 3.1% and 5.7%. Individual income tax kansas itemized deductions. 2022 income tax that was actually paid to the other state (including political subdivisions thereof): Individual income tax supplemental schedule. A printer (if you want to print. Web kansas income tax forms. Current ks tax year tax forms you can efile. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web died during this tax year, mark an “x” in this box. Previous tax year or kansas income back taxes forms. 1) you are required to file a federal income tax. File your state taxes online; Web income allocation form; Web kansas has a state income tax that ranges between 3.1% and 5.7%, which is administered by the kansas department of.

Individual Income Tax Supplemental Schedule.

File your state taxes online; Web kansas has a state income tax that ranges between 3.1% and 5.7%, which is administered by the kansas department of. A printer (if you want to print. File your state taxes online;

Web Income Allocation Form;

Web kansas income tax forms. Web your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. If you make $70,000 a year living in kansas you. Individual income tax kansas itemized deductions.

Web These Where To File Addresses Are To Be Used Only By Taxpayers And Tax Professionals Filing Individual Federal Tax.

Web kansas has a state income tax that ranges between 3.1% and 5.7%. Previous tax year or kansas income back taxes forms. Web a completed 2021 federal income tax return, if you are required to file; Web the kansas tax forms are listed by tax year below and all ks back taxes for previous years would have to be mailed in.

1) You Are Required To File A Federal Income Tax.

Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web died during this tax year, mark an “x” in this box. Web kansas income tax forms. Current ks tax year tax forms you can efile.