Lansing Mi Tax Forms - Web 2022 tax year forms and instructions. Web most commonly used forms & instructions. Web browse through the tax return forms for prior years. Web see options to pay tax and applicable tax rates. Completed forms for individuals, corporations and partnerships should be sent to the following address: Web access income tax forms. Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local income tax. All lansing income tax forms are available on the city’s website,. Web city income tax forms. Individual income tax forms and instructions.

2018 online individual tax form for city of lansing Fill out

Web application for extension of time to file michigan tax returns: Web city income tax forms. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on. Web browse through the tax return forms for prior years. Web welcome to the city of lansing.

City Of Lansing Tax Forms 2021 Fill Out and Sign Printable PDF

Web city income tax forms. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Web learn about property tax, income tax, employer withholding, false alarm system registration and invoice payments as well. Web application for extension of time to file michigan tax returns: Web tax at {tax rate} (multiply line 22 by lansing resident.

MI L1120 Lansing City 2020 Fill out Tax Template Online US Legal

All lansing income tax forms are available on the city’s website,. Web michigan taxes, tax, income tax, business tax, sales tax, tax form, 1040, w9, treasury, withholding Web see options to pay tax and applicable tax rates. State — state of michigan taxes. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or.

Form Lw4 Employee'S Withholding Certificate For City Of Lansing

Web city income tax forms. Web see options to pay tax and applicable tax rates. Individual income tax forms and instructions. Completed forms for individuals, corporations and partnerships should be sent to the following address: Web 2022 tax year forms and instructions.

Michigan Tax Forms Printable Printable Forms Free Online

Web learn about property tax, income tax, employer withholding, false alarm system registration and invoice payments as well. State — state of michigan taxes. Web browse through the tax return forms for prior years. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Web 2022 tax year forms and instructions.

Fillable Lansing City Tax Forms Printable Forms Free Online

Completed forms for individuals, corporations and partnerships should be sent to the following address: Web city income tax forms. Web michigan taxes, tax, income tax, business tax, sales tax, tax form, 1040, w9, treasury, withholding Web see options to pay tax and applicable tax rates. Web online access to tax information local — lansing tax forms.

Form L1040x City Of Lansing Tax Amended Individual Return

Individual income tax forms and instructions. All lansing income tax forms are available on the city’s website,. Web • mostcommonly used tax forms • freeassistance in preparing your return • retirement and pension deduction. Web online access to tax information local — lansing tax forms. Web city income tax forms.

Form L1040r Lansing Resident Tax Return 2000 printable pdf

Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Web online access to tax information local — lansing tax forms. Web see options to pay tax and.

Resident Tax Return Form Schedule Rz Calculation Or

Web • mostcommonly used tax forms • freeassistance in preparing your return • retirement and pension deduction. Web online access to tax information local — lansing tax forms. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and. Completed forms for individuals, corporations and partnerships should be.

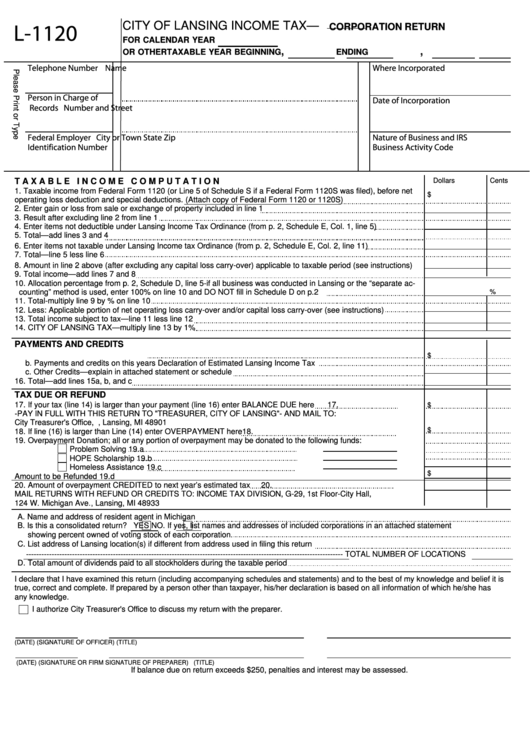

Fillable Form L1120 Tax Corporation Return City Of Lansing

Web michigan taxes, tax, income tax, business tax, sales tax, tax form, 1040, w9, treasury, withholding Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on. Web browse through the tax return forms for prior years. Web the east lansing income tax forms.

Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. State — state of michigan taxes. Web 2022 tax year forms and instructions. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on. Web city income tax forms. Web learn about property tax, income tax, employer withholding, false alarm system registration and invoice payments as well. All lansing income tax forms are available on the city’s website,. Individual income tax forms and instructions. Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local income tax. Web michigan taxes, tax, income tax, business tax, sales tax, tax form, 1040, w9, treasury, withholding Web • mostcommonly used tax forms • freeassistance in preparing your return • retirement and pension deduction. Web see options to pay tax and applicable tax rates. Web most commonly used forms & instructions. Web browse through the tax return forms for prior years. Completed forms for individuals, corporations and partnerships should be sent to the following address: Web city income tax forms. Web online access to tax information local — lansing tax forms. Web application for extension of time to file michigan tax returns: Web access income tax forms.

Tax At {Tax Rate} (Multiply Line 22 By Lansing Resident Tax Rate Of 1.% (0.01) Or Nonresident Tax Rate Of 0.5% (0.005) And.

Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Web application for extension of time to file michigan tax returns: Individual income tax forms and instructions. Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local income tax.

Web City Income Tax Forms.

State — state of michigan taxes. Web 2022 tax year forms and instructions. Web most commonly used forms & instructions. Web access income tax forms.

Web Learn About Property Tax, Income Tax, Employer Withholding, False Alarm System Registration And Invoice Payments As Well.

Web online access to tax information local — lansing tax forms. Web browse through the tax return forms for prior years. Web city income tax forms. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on.

Web • Mostcommonly Used Tax Forms • Freeassistance In Preparing Your Return • Retirement And Pension Deduction.

Web michigan taxes, tax, income tax, business tax, sales tax, tax form, 1040, w9, treasury, withholding All lansing income tax forms are available on the city’s website,. Completed forms for individuals, corporations and partnerships should be sent to the following address: Web see options to pay tax and applicable tax rates.