Md Form 510 - Web we last updated maryland form 510d in january 2023 from the maryland comptroller of maryland. Web subtotal from additional form 510 schedule b for individual members total: Web subtotal from additional form 510 schedule b for individual members total: Web in light of the recent law and administrative changes, the comptroller recently released an updated version of. This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. This form is for income. You must file maryland form 510. This form is for income. This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e.

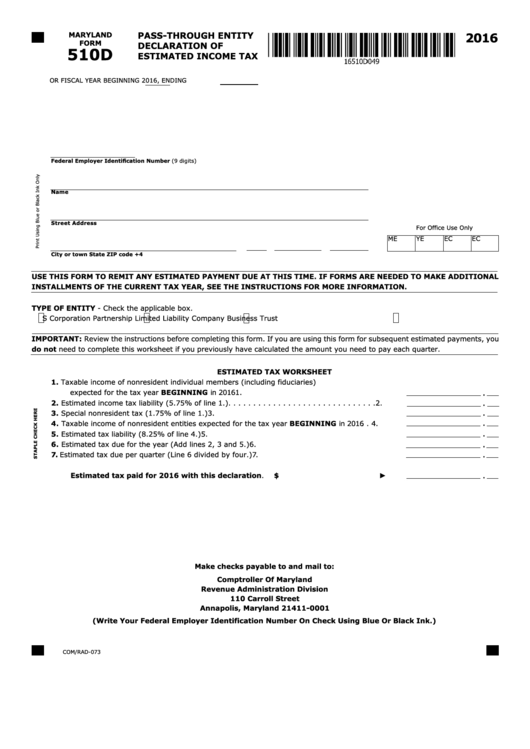

Fillable Maryland Form 510d PassThrough Entity Declaration Of

This affirms the instructions for. This form is for income. This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Taxpayers that have already made the pte election by filing form 510 should file form 511.

Fillable Maryland Form 510e Application For Extension To File Pass

Web maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. We last updated the declaration of estimated. You must file maryland form 510 electronically to pass on business tax.

Fillable Maryland Form 510 PassThrough Entity Tax Return

This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. You must file maryland form 510 electronically to pass on business tax credits from. Web subtotal from additional form 510 schedule b for individual members total: Any pte that has credits in maryland and a pte that is a member of a.

Instructions For Maryland Form 510e Application For Extension Oftime

Web in light of the recent law and administrative changes, the comptroller recently released an updated version of. This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Taxpayers that have already made the pte election.

Md 510D Fill Out and Sign Printable PDF Template signNow

Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. You must file maryland form 510. You must file maryland form 510 electronically to pass on business tax credits from. This affirms the instructions for. Web in light of the recent law and administrative changes, the comptroller recently released an updated.

Download Instructions for Maryland Form 510, COM/RAD069 PassThrough

Web subtotal from additional form 510 schedule b for individual members total: Web we last updated maryland form 510d in january 2023 from the maryland comptroller of maryland. This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. This form is for income. We last updated the declaration of estimated.

Fillable Form 510e Maryland Application For Extension To File Pass

Web subtotal from additional form 510 schedule b for individual members total: Taxpayers that have already made the pte election by filing form 510 should file form 511 before. This form is for income. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Web in light of the recent law.

Download Instructions for Maryland Form 510, COM/RAD069 PassThrough

Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Web in light of the recent law and administrative changes, the comptroller recently released an updated version of. This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Taxpayers that have already made.

Fillable Online Instructions Maryland Form 510 Fax Email Print pdfFiller

This affirms the instructions for. This form is for income. Web in light of the recent law and administrative changes, the comptroller recently released an updated version of. Web maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. You must file maryland form 510.

Download Instructions for Maryland Form 510, COM/RAD069 PassThrough

Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. You must file maryland form 510 electronically to pass on business tax credits from. Web in light of the recent law and administrative changes, the comptroller recently released an updated version of. Any pte that has credits in maryland and a pte that is.

Web maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. We last updated the declaration of estimated. Taxpayers that have already made the pte election by filing form 510 should file form 511 before. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. You must file maryland form 510 electronically to pass on business tax credits from. Web we last updated maryland form 510d in january 2023 from the maryland comptroller of maryland. Any pte that has credits in maryland and a pte that is a member of a pte that is required to file. Web in light of the recent law and administrative changes, the comptroller recently released an updated version of. This form is for income. You must file maryland form 510. This affirms the instructions for. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. This form is for income. Web subtotal from additional form 510 schedule b for individual members total: Web subtotal from additional form 510 schedule b for individual members total:

Taxpayers That Have Already Made The Pte Election By Filing Form 510 Should File Form 511 Before.

This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. You must file maryland form 510 electronically to pass on business tax credits from. Web we last updated maryland form 510d in january 2023 from the maryland comptroller of maryland.

Web Subtotal From Additional Form 510 Schedule B For Individual Members Total:

You must file maryland form 510. This form is for income. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. This form is for income.

Any Pte That Has Credits In Maryland And A Pte That Is A Member Of A Pte That Is Required To File.

Web subtotal from additional form 510 schedule b for individual members total: Web in light of the recent law and administrative changes, the comptroller recently released an updated version of. This affirms the instructions for. Web maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510.

We Last Updated The Declaration Of Estimated.

This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation.