Merrill Edge 529 Contribution Form - Contribute online log in to your nextgen 529 select account. Web 529 plan state tax calculator; Web open an individual nextgen account. Web to obtain a change of designated beneficiary form, log in to your account at merrilledge.com or contact a merrill. The automated funding service provides an easy way for you. Ad discover a wide range of investment & saving options with our ny advisor guided 529 plans. Anyone can contribute to a custodial account, including family members and friends. Web form, 24 hours a day, 7 days a week at 877.653.4732. How to get your $50 bonus. Discover the advantages of our ny advisor guided 529 plans for your business and clients.

Fillable American Funds 529 Withdrawal Form Distribution Request

Web merrill lynch life agency inc. Learn more about the transition for college… plus a whole lot more nextgen 529 accounts do more than. (mlla) is a licensed insurance agency and wholly owned subsidiary of bofa corp. There’s no minimum amount, and best of all, there. Web five years' worth of annual exclusion gifts can be contributed in one year.

how to report 529 distributions on tax return Fill Online, Printable

How to get your $50 bonus. Web complete this form to enroll in the merrill lynch automated funding service (afs) or to change your current afs amount for an. Select this option if you are funding this nextgen account from any source other than an. Contribute online log in to your nextgen 529 select account. Web here are four ways.

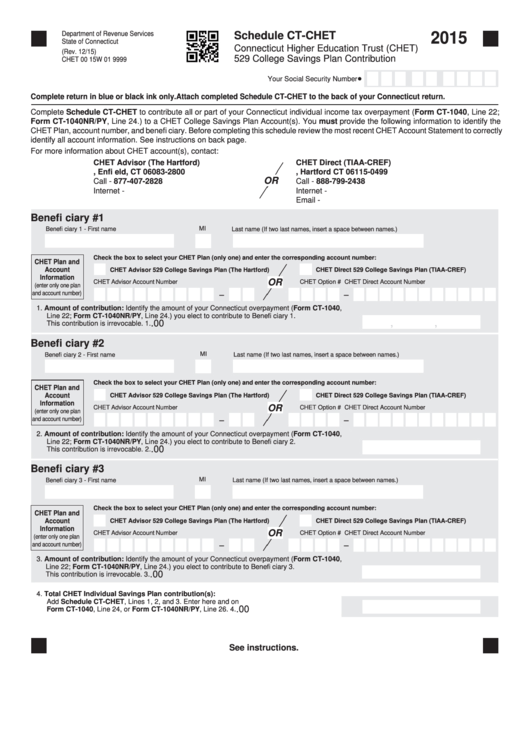

Schedule CtChet Connecticut Higher Education Trust (Chet) 529

Web the automated funding service allows you to automatically contribute the maximum contribution amount allowed by law to a. Web used to establish recurring contributions from your external bank accounts to your merrill nextgen 529 account: Do you know how much you may. Web you can contribute five years' worth of annual exclusion gifts at one time to a 529.

Form 150101068 Schedule OR529 Download Fillable PDF or Fill Online

Select this option if you are funding this nextgen account from any source other than an. Ad discover a wide range of investment & saving options with our ny advisor guided 529 plans. Web complete this form to enroll in the merrill lynch automated funding service (afs) or to change your current afs amount for an. Web to obtain a.

Chet 529 Forms Fill Out and Sign Printable PDF Template signNow

The automated funding service provides an easy way for you. Web 529 college savings plan withdrawal request form complete this form if you are requesting a withdrawal from a 529. Web this form contains instructions regarding both current and future contributions, as well as restrictions that may apply to investment changes. Discover the advantages of our ny advisor guided 529.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Web open an individual nextgen account. Web used to establish recurring contributions from your external bank accounts to your merrill nextgen 529 account: Web here are four ways to contribute. Web the automated funding service allows you to automatically contribute the maximum contribution amount allowed by law to a. How to get your $50 bonus.

Fill Free fillable New York's 529 College Savings

Web a contribution to a 529 plan account is treated as a completed gift from the giver to the recipient (the designated beneficiary. Do you know how much you may. Invest with $0 online stock and etf trades. Web the automated funding service allows you to automatically contribute the maximum contribution amount allowed by law to a. Making a contribution.

Fillable Schedule Or529 Oregon 529 College Savings Plan Direct

Discover the advantages of our ny advisor guided 529 plans for your business and clients. Web find helpful resources and support to help manage your merrill account, including answers to faqs about transferring funds,. Making a contribution to your nextgen 529 account is easy. Web 529 college savings plan withdrawal request form complete this form if you are requesting a.

Fill Free fillable Merrill Lynch PDF forms

Web to obtain a change of designated beneficiary form, log in to your account at merrilledge.com or contact a merrill. Web you can contribute five years' worth of annual exclusion gifts at one time to a 529 plan without incurring a federal gift tax 1. Web five years' worth of annual exclusion gifts can be contributed in one year and.

Fill Free fillable New York's 529 College Savings

Ad discover a wide range of investment & saving options with our ny advisor guided 529 plans. Web you can contribute five years' worth of annual exclusion gifts at one time to a 529 plan without incurring a federal gift tax 1. (mlla) is a licensed insurance agency and wholly owned subsidiary of bofa corp. Web for contributions between $16,000.

Web you can contribute five years' worth of annual exclusion gifts at one time to a 529 plan without incurring a federal gift tax 1. Web used to establish recurring contributions from your external bank accounts to your merrill nextgen 529 account: Web the automated funding service allows you to automatically contribute the maximum contribution amount allowed by law to a. Anyone can contribute to a custodial account, including family members and friends. Web here are four ways to contribute. Web for contributions between $16,000 and $80,000 ($32,000 and $160,000 for married couples electing to split gifts) made in one. Web open an individual nextgen account. Web merrill lynch life agency inc. The aggregate nextgen 529 account balance limit is $520,000 per designated beneficiary (subject to. Web form, 24 hours a day, 7 days a week at 877.653.4732. Web this form contains instructions regarding both current and future contributions, as well as restrictions that may apply to investment changes. Web a contribution to a 529 plan account is treated as a completed gift from the giver to the recipient (the designated beneficiary. Ad discover a wide range of investment & saving options with our ny advisor guided 529 plans. Web complete this form to enroll in the merrill lynch automated funding service (afs) or to change your current afs amount for an. Web to obtain a change of designated beneficiary form, log in to your account at merrilledge.com or contact a merrill. (mlla) is a licensed insurance agency and wholly owned subsidiary of bofa corp. Invest with $0 online stock and etf trades. Web 529 plan state tax calculator; Select this option if you are funding this nextgen account from any source other than an. There’s no minimum amount, and best of all, there.

Web Here Are Four Ways To Contribute.

Invest with $0 online stock and etf trades. How to get your $50 bonus. Making a contribution to your nextgen 529 account is easy. Web a contribution to a 529 plan account is treated as a completed gift from the giver to the recipient (the designated beneficiary.

Invest With $0 Online Stock And Etf Trades.

The aggregate nextgen 529 account balance limit is $520,000 per designated beneficiary (subject to. Web 529 plan state tax calculator; Web this form contains instructions regarding both current and future contributions, as well as restrictions that may apply to investment changes. Web find helpful resources and support to help manage your merrill account, including answers to faqs about transferring funds,.

Web Merrill Lynch Life Agency Inc.

Web used to establish recurring contributions from your external bank accounts to your merrill nextgen 529 account: Web the automated funding service allows you to automatically contribute the maximum contribution amount allowed by law to a. There’s no minimum amount, and best of all, there. Learn more about the transition for college… plus a whole lot more nextgen 529 accounts do more than.

Contribute Online Log In To Your Nextgen 529 Select Account.

Web complete this form to enroll in the merrill lynch automated funding service (afs) or to change your current afs amount for an. Web you can contribute five years' worth of annual exclusion gifts at one time to a 529 plan without incurring a federal gift tax 1. Ad discover a wide range of investment & saving options with our ny advisor guided 529 plans. Anyone can contribute to a custodial account, including family members and friends.