Pa Lst Exemption Form - File completed application with keystone collections group, po box 559, irwin, pa. If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income. Web local services tax exemption application. Web employer due dates for 2022 download employer forms lst employee exemption certificate download lst employee. Web taxpayer application for exemption from local services tax (lst). Web tax credits and incentives. Name address city/state zip tax year ssn phone. Web if the total lst rate enacted exceeds $10.00, the act requires that all jurisdictions exempt individuals with incomes within their. Web political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income. Web local services tax exemption certificate and refund form.

Application For Exemption From The Local Services Tax Pennsylvania

Web if the total lst rate enacted exceeds $10.00, the act requires that all jurisdictions exempt individuals with incomes within their. Web local services tax exemption certificate and refund form. Web form to the pa department of revenue. Web an exemption certificate can be obtained at the city web site www.city.pittsburgh.pa.us/finance a copy should be forwarded to pittsburgh and the..

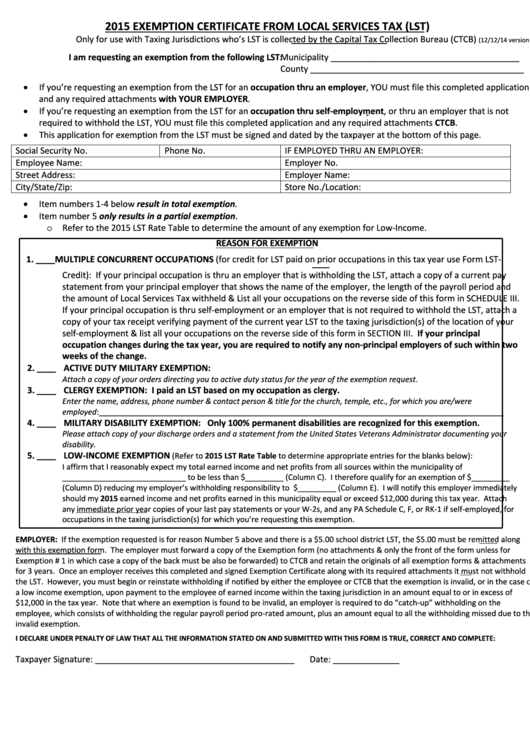

Exemption Certificate From Local Services Tax (Lst) Pennsylvania

Web form to the pa department of revenue. File completed application with keystone collections group, po box 559, irwin, pa. Are you exempt from paying the local services tax? Web 13 nov 2023 local income tax requirements for employers employers with worksites located in pennsylvania are required to. Web tax credits and incentives.

Pa Sales Tax Exemption Form 2023

If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income. Web employer due dates for 2022 download employer forms lst employee exemption certificate download lst employee. Web taxpayer application for exemption from local services tax (lst). Web 13 nov 2023 local income tax requirements for employers employers with worksites located in.

Tax Exempt Fillable Form Pa Printable Forms Free Online

Web tax credits and incentives. This form may be used in conjunction with form. Web employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst) on. File completed application with keystone collections group, po box 559, irwin, pa. Are you exempt from paying the local services tax?

Bupa Tax Exemption Form TX 14312 2012 Fill out Tax Template Online

Web employers located in an area that has an lst rate that exceeds $10, there is a mandatory income exemption for those whose total. Web local services tax exemption application. Web form to the pa department of revenue. Web a copy of this application for exemption from the local services tax (lst), and all necessary supporting. List all employers on.

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

File completed application with keystone collections group, po box 559, irwin, pa. Web employers located in an area that has an lst rate that exceeds $10, there is a mandatory income exemption for those whose total. Web if the total lst rate enacted exceeds $10.00, the act requires that all jurisdictions exempt individuals with incomes within their. Web 13 nov.

Form Lst1 Local Services Tax York County, Pennsylvania printable

Web a copy of this application for exemption from the local services tax (lst), and all necessary supporting. Web form to the pa department of revenue. Name address city/state zip tax year ssn phone. Web taxpayer application for exemption from local services tax (lst). Web 13 nov 2023 local income tax requirements for employers employers with worksites located in pennsylvania.

Free Printable Pa Tax Forms Printable Forms Free Online

Web employer due dates for 2022 download employer forms lst employee exemption certificate download lst employee. Name address city/state zip tax year ssn phone. Web employers located in an area that has an lst rate that exceeds $10, there is a mandatory income exemption for those whose total. Web political subdivisions that levy an lst at a rate that exceeds.

PA Warwick Township LST Quarterly Tax Return Fill out Tax Template

Web taxpayer application for exemption from local services tax (lst). Web employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst) on. Web political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income. Web form.

Local Service Tax Exemption Certificate City Of Pittsburgh 2010

Are you exempt from paying the local services tax? Single employer multiple employer pennsylvania standard file format. Web a copy of this application for exemption from the local services tax (lst), and all necessary supporting. Web local services tax exemption certificate and refund form. Web local services tax exemption application.

Web political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income. Web employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst) on. Web 13 nov 2023 local income tax requirements for employers employers with worksites located in pennsylvania are required to. Name address city/state zip tax year ssn phone. Web employers located in an area that has an lst rate that exceeds $10, there is a mandatory income exemption for those whose total. Single employer multiple employer pennsylvania standard file format. This form may be used in conjunction with form. Web local services tax exemption application. Due dates [pdf] tax types. Are you exempt from paying the local services tax? List all employers on the reverse side of this. If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income. Web a copy of this application for exemption from the local services tax (lst), and all necessary supporting. Web local services tax exemption certificate and refund form. Web taxpayer application for exemption from local services tax (lst). Web if the total lst rate enacted exceeds $10.00, the act requires that all jurisdictions exempt individuals with incomes within their. List all employers on the reverse side of this. File completed application with keystone collections group, po box 559, irwin, pa. Web an exemption certificate can be obtained at the city web site www.city.pittsburgh.pa.us/finance a copy should be forwarded to pittsburgh and the. Web form to the pa department of revenue.

This Form May Be Used In Conjunction With Form.

Are you exempt from paying the local services tax? Web an exemption certificate can be obtained at the city web site www.city.pittsburgh.pa.us/finance a copy should be forwarded to pittsburgh and the. Name address city/state zip tax year ssn phone. Web form to the pa department of revenue.

Web Tax Credits And Incentives.

Web local services tax exemption application. Web a copy of this application for exemption from the local services tax (lst), and all necessary supporting. Web taxpayer application for exemption from local services tax (lst). Web local services tax exemption certificate and refund form.

File Completed Application With Keystone Collections Group, Po Box 559, Irwin, Pa.

List all employers on the reverse side of this. If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income. Web employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst) on. List all employers on the reverse side of this.

Web If The Total Lst Rate Enacted Exceeds $10.00, The Act Requires That All Jurisdictions Exempt Individuals With Incomes Within Their.

Web employer due dates for 2022 download employer forms lst employee exemption certificate download lst employee. Single employer multiple employer pennsylvania standard file format. Web 13 nov 2023 local income tax requirements for employers employers with worksites located in pennsylvania are required to. Web political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income.