Pro Forma Tax Return - Web to pro forma a return, do the following: Web while a de is not required to file a u.s. Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472 attached by the due. Web there are two ways to create a return from a pro forma file: Web pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. Select the tax year that you want to roll. Web pro forma tax returns are completed on an “what if” basis, using projected income and expenses to see the tax ramifications of a hypothetical scenario.

Form 720 Schedule Cr Pro Forma Federal Consolidated Return Schedule

Select the tax year that you want to roll. Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472 attached by the due. Web pro forma tax returns are completed on an “what if” basis, using projected income and expenses to see the tax ramifications of a hypothetical scenario..

FREE 12+ Tax Invoice Templates in Google Docs Pages Numbers MS Word

Web while a de is not required to file a u.s. Select the tax year that you want to roll. Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472 attached by the due. Web pro forma tax returns are completed on an “what if” basis, using projected income.

Pro Forma Tax Return on Vimeo

Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472 attached by the due. Web there are two ways to create a return from a pro forma file: Web while a de is not required to file a u.s. Web to pro forma a return, do the following: Select.

What Is Pro Forma Invoice Format And Status Under GST Sample Template

Web there are two ways to create a return from a pro forma file: Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472 attached by the due. Web pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating.

Proforma Tax Expense Tax Deduction

Web pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. Web while a de is not required to file a u.s. Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472.

Schedule Cr (Form 720) Pro Forma Federal Consolidated Return Schedule

Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472 attached by the due. Web while a de is not required to file a u.s. Select the tax year that you want to roll. Web to pro forma a return, do the following: Web pro forma tax returns are.

Pro Forma Excel Spreadsheet Excel Templates

Web pro forma tax returns are completed on an “what if” basis, using projected income and expenses to see the tax ramifications of a hypothetical scenario. Web there are two ways to create a return from a pro forma file: Web while a de is not required to file a u.s. Web pro forma, latin for “as a matter of.

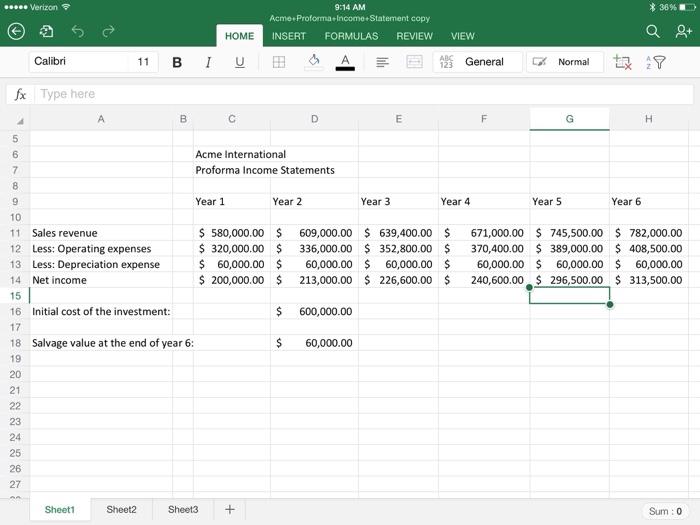

Based on the information provided in the proforma

Web pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472 attached by the due. Web while a de is not required.

Proforma Tax Invoice * Invoice Template Ideas

Web pro forma tax returns are completed on an “what if” basis, using projected income and expenses to see the tax ramifications of a hypothetical scenario. Web there are two ways to create a return from a pro forma file: Web to pro forma a return, do the following: Select the tax year that you want to roll. Web while.

Proforma Invoice Templates Quickly Create & Send Proformas

Web while a de is not required to file a u.s. Web pro forma tax returns are completed on an “what if” basis, using projected income and expenses to see the tax ramifications of a hypothetical scenario. Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472 attached by.

Web to pro forma a return, do the following: Select the tax year that you want to roll. Web pro forma tax returns are completed on an “what if” basis, using projected income and expenses to see the tax ramifications of a hypothetical scenario. Web there are two ways to create a return from a pro forma file: Web while a de is not required to file a u.s. Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472 attached by the due. Web pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions.

Web Pro Forma Tax Returns Are Completed On An “What If” Basis, Using Projected Income And Expenses To See The Tax Ramifications Of A Hypothetical Scenario.

Select the tax year that you want to roll. Web pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. Web there are two ways to create a return from a pro forma file: Web to pro forma a return, do the following:

Web While A De Is Not Required To File A U.s.

Income tax return, a de covered by these rules is required to file a pro forma form 1120 with form 5472 attached by the due.