Schedule A Form 5500 Instructions - Web there’s a lot that goes into completing the form 5500, with its 27 pages of instructions. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including. Web this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). This is why so many employers rely on their 401(k). 29, 2023 — the internal revenue service today reminded taxpayers about the upcoming tax filing extension. Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds. Web form 5500 will vary according to the type of plan or arrangement. Web one is filing form 5500, which summarizes your company’s compliance with employee benefit plans (ebps). This schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Web form 5500 annual return/report of employee benefit plan | instructions;

Form 5500 Schedule A Instructions Insurance Information 2002

Web form 5500 (all other filers) 82 hr., 16 min. See the instructions for schedules on page 6. Web one is filing form 5500, which summarizes your company’s compliance with employee benefit plans (ebps). Form 5500 must be filed by the last day of the seventh calendar month after. Web this schedule is required to be filed under section 104.

Understanding the Form 5500 for Defined Benefit Plans Fidelity

48 min.9 hr., 32 min. This schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Web when you sign form 5500, you’re personally liable for the 401 (k). Web when and how do i file form 5500? 29, 2023 — the internal revenue service today reminded taxpayers about the.

Form 5500 Instructions 5 Steps to Filing Correctly

Web schedule a (form 5500) must be attached to the form 5500 filed for every defined benefit pension plan, defined contribution pension. Signing and submitting the form 5500 means a ton of risk on your. Web filing a form 5500 annual return/report of employee benefit plan (form 5500) or, if eligible, a form. Web this schedule is required to be.

IRS Form 5500 Schedule D Download Fillable PDF or Fill Online Dfe

Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. Web when you sign form 5500, you’re personally liable for the 401 (k). Web one is filing form 5500, which summarizes your company’s compliance with employee benefit plans (ebps). Signing and submitting the form 5500 means a ton of.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including. Form 5500 must be filed by the last day of the seventh calendar month after. Web this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). This is why so many employers rely on.

Form 5500 Schedule Mb Multiemployer Defined Benefit Plan And

This is why so many employers rely on their 401(k). Department of labor, internal revenue service, and the pension benefit guaranty corporation. 29, 2023 — the internal revenue service today reminded taxpayers about the upcoming tax filing extension. See the instructions for schedules on page 6. The section what to file summarizes what information must.

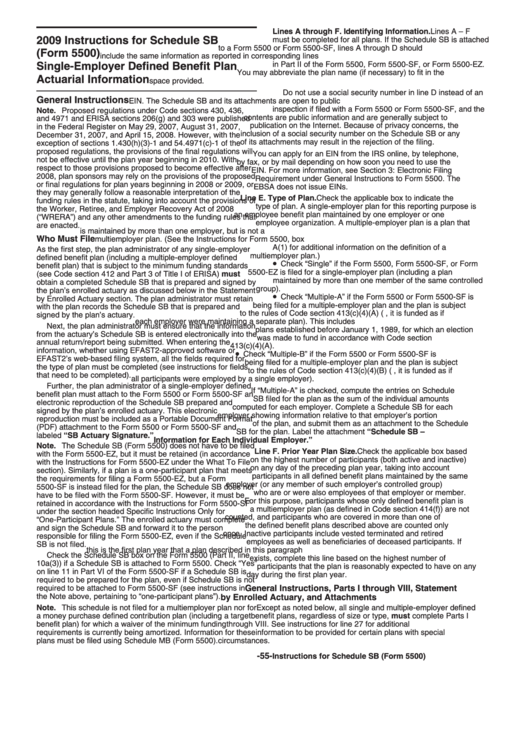

2009 Instructions For Schedule Sb (Form 5500) SingleEmployer Defined

Department of labor, internal revenue service, and the pension benefit guaranty corporation. Web form 5500 will vary according to the type of plan or arrangement. Web form 5500 reporting requirements, and whether a schedule a or c is required, depends on the size of the plan. 29, 2023 — the internal revenue service today reminded taxpayers about the upcoming tax.

2018 Updated Form 5500EZ Guide Solo 401k

Web schedule, such as the schedule a (form 5500). An annual return/report must be filed for employee welfare. The section what to file summarizes what information must. Web this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). 48 min.9 hr., 32 min.

Form 5500 Fill Out and Sign Printable PDF Template signNow

Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. See the instructions for schedules on page 6. Form 5500 must be filed by the last day of the seventh calendar month after. Department of labor, internal revenue service, and the pension benefit guaranty corporation. Web schedule, such as the.

Form 5500 Instructions 5 Steps to Filing Correctly

Web form 5500 is used for plans that have 100 or more participants. 29, 2023 — the internal revenue service today reminded taxpayers about the upcoming tax filing extension. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including. Signing and submitting the form 5500 means a ton of risk on your. Web .

Web there’s a lot that goes into completing the form 5500, with its 27 pages of instructions. 29, 2023 — the internal revenue service today reminded taxpayers about the upcoming tax filing extension. The section what to file summarizes what information must. Web form 5500 reporting requirements, and whether a schedule a or c is required, depends on the size of the plan. Web form 5500 is used for plans that have 100 or more participants. Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. Web when you sign form 5500, you’re personally liable for the 401 (k). Web when and how do i file form 5500? Web see what to file. An annual return/report must be filed for employee welfare. See the instructions for schedules on page 6. This schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Form 5500 must be filed by the last day of the seventh calendar month after. This is why so many employers rely on their 401(k). Web today, the u.s. Web form 5500 will vary according to the type of plan or arrangement. Web filing a form 5500 annual return/report of employee benefit plan (form 5500) or, if eligible, a form. Web this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Web schedule a (form 5500) must be attached to the form 5500 filed for every defined benefit pension plan, defined contribution pension. Schedule a (form 5500) 17 hr., 28 min.

See The Instructions For Schedules On Page 6.

This schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Web form 5500 (all other filers) 82 hr., 16 min. Web form 5500 will vary according to the type of plan or arrangement. Web form 5500 is used for plans that have 100 or more participants.

48 Min.9 Hr., 32 Min.

Web filing a form 5500 annual return/report of employee benefit plan (form 5500) or, if eligible, a form. Web schedule, such as the schedule a (form 5500). Web form 5500 reporting requirements, and whether a schedule a or c is required, depends on the size of the plan. An annual return/report must be filed for employee welfare.

Web Generally, Any Business That Sponsors A Retirement Savings Plan Must File A Form 5500 Each Year That The Plan Holds.

This is why so many employers rely on their 401(k). Web form 5500 instructions 2020 series was jointly designed by the department of labor (dol), the internal revenue service (irs),. Form 5500 must be filed by the last day of the seventh calendar month after. The section what to file summarizes what information must.

Web This Clarification Is Proposed To Be Added To The 2023 Form 5500 Instructions For Line 26B Of Schedule Sb.

Signing and submitting the form 5500 means a ton of risk on your. Department of labor, internal revenue service, and the pension benefit guaranty corporation. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including. Web there’s a lot that goes into completing the form 5500, with its 27 pages of instructions.