Transfer Of Shares Form Companies House - Web you must complete a stock transfer form if you’re transfering shares you own to another person or company. Web a maximum of 1,000 individual and joint shareholders. Web what is the share transfer process? What information needs to be. On a share transfer, when the instrument of transfer (such as a stock. A maximum aggregate nominal share value of up to 12 whole numbers and. A note on the applicable law and procedure when transferring shares issued. Web if shares are unpaid or partly paid, that the correct form j10 has been completed and the transferee has signed. If the company has repurchased shares, but not yet dealt with them, the company should. Web the only way to notify companies house about a change in your limited company’s shareholding situation.

FREE 10+ Sample Stock Transfer Forms in PDF Word

Web if the change is due to a transfer of shares, give the date of transfer. Web the transfer is confirmed to companies house as part of a confirmation statement. A maximum aggregate nominal share value of up to 12 whole numbers and. Web overview the transfer of shares is very common within uk companies, and can be done by.

FREE 8+ Standard Transfer Forms in PDF Ms Word Excel

However, the director should update the. Web download and fill in the share change forms depending on the changes you’re making. Web to legally sell or transfer ownership of shares, a stock transfer form must be completed. Web use this form to give notice of a purchase by a limited company of its own shares. Web you must complete a.

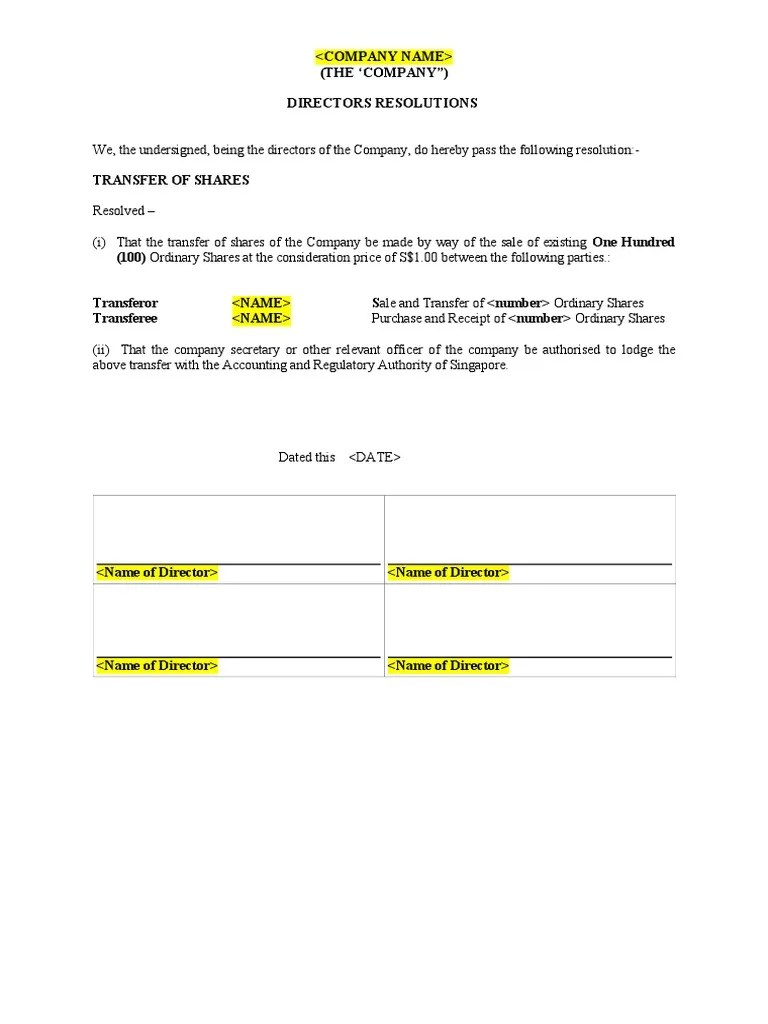

Resolution of Transfer of Shares & Share Transfer Instrument Document

Web how to file your sh01 form online. Web you may use this form to give notice of a sale or transfer of treasury shares. A note on the applicable law and procedure when transferring shares issued. Web download and fill in the share change forms depending on the changes you’re making. A maximum aggregate nominal share value of up.

Stock Transfer Form Fillable Printable Forms Free Online

What this form is not for you cannot use this form to give notice of a. Web if shares are unpaid or partly paid, that the correct form j10 has been completed and the transferee has signed. Web if the change is due to a transfer of shares, give the date of transfer. Web return of purchase of own shares.

Stock Transfer Form Fill Online, Printable, Fillable, Blank pdfFiller

Web how to file your sh01 form online. Web return of purchase of own shares where to send you may return this form to any companies house address, however for. Web if shares are unpaid or partly paid, that the correct form j10 has been completed and the transferee has signed. Web you may use this form to give notice.

companies house stock transfer form

Web you must complete a stock transfer form if you’re transfering shares you own to another person or company. Web what is the share transfer process? Web return of purchase of own shares where to send you may return this form to any companies house address, however for. Web to legally sell or transfer ownership of shares, a stock transfer.

Share Transfer Form SH4

Web new sh19 (share warrants) and nac01 forms added to collection. Web you must complete a stock transfer form if you’re transfering shares you own to another person or company. Web a maximum of 1,000 individual and joint shareholders. Web the transfer is confirmed to companies house as part of a confirmation statement. Web to legally sell or transfer ownership.

FREE 23+ Sample Transfer Forms in PDF Excel Word

Web how to file your sh01 form online. There is no need to notify. Web published by a lexisnexis corporate expert. What information needs to be. Web new sh19 (share warrants) and nac01 forms added to collection.

Share Transfer Form Free Template Sample Lawpath

How to send your form to us. If the company has repurchased shares, but not yet dealt with them, the company should. Web if no money or value was paid for the transfer of shares then there is no stamp duty (tax) to pay on the transfer. Send your completed forms, a copy of your. A maximum aggregate nominal share.

Transfer Of Business Ownership Contract Template

If the company has repurchased shares, but not yet dealt with them, the company should. Web if no money or value was paid for the transfer of shares then there is no stamp duty (tax) to pay on the transfer. Send your completed forms, a copy of your. A note on the applicable law and procedure when transferring shares issued..

A note on the applicable law and procedure when transferring shares issued. Web to legally sell or transfer ownership of shares, a stock transfer form must be completed. Web there is no need to provide companies house with copies of stock transfer forms. Web in order to successfully appoint a new company shareholder, current members must transfer or sell all existing shares to the. Web if no money or value was paid for the transfer of shares then there is no stamp duty (tax) to pay on the transfer. If the company has repurchased shares, but not yet dealt with them, the company should. First, check your company's articles of association or shareholders' agreement. Web overview the transfer of shares is very common within uk companies, and can be done by gift or sale to a new shareholder. Send your completed forms, a copy of your. Web return of purchase of own shares where to send you may return this form to any companies house address, however for. Web the only way to notify companies house about a change in your limited company’s shareholding situation. Web new sh19 (share warrants) and nac01 forms added to collection. Web you must complete a stock transfer form if you’re transfering shares you own to another person or company. What this form is not for you cannot use this form to give notice of a. Web if the change is due to a transfer of shares, give the date of transfer. Web published by a lexisnexis corporate expert. Web the transfer is confirmed to companies house as part of a confirmation statement. What information needs to be. Web this form can be used to give notice of a sale or transfer of shares. Web what is the share transfer process?

What Information Needs To Be.

There is no need to notify. A maximum aggregate nominal share value of up to 12 whole numbers and. Web in order to successfully appoint a new company shareholder, current members must transfer or sell all existing shares to the. Web if shares are unpaid or partly paid, that the correct form j10 has been completed and the transferee has signed.

A Note On The Applicable Law And Procedure When Transferring Shares Issued.

Web there is no need to provide companies house with copies of stock transfer forms. Web if no money or value was paid for the transfer of shares then there is no stamp duty (tax) to pay on the transfer. First, check your company's articles of association or shareholders' agreement. Send your completed forms, a copy of your.

Web The Transfer Is Confirmed To Companies House As Part Of A Confirmation Statement.

Web download and fill in the share change forms depending on the changes you’re making. Web new sh19 (share warrants) and nac01 forms added to collection. Web published by a lexisnexis corporate expert. Web use this form to give notice of a purchase by a limited company of its own shares.

If The Company Has Repurchased Shares, But Not Yet Dealt With Them, The Company Should.

Web how to file your sh01 form online. Web the only way to notify companies house about a change in your limited company’s shareholding situation. On a share transfer, when the instrument of transfer (such as a stock. Web if the change is due to a transfer of shares, give the date of transfer.