What Is Form 8814 Used For - Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Web this form is used to report the child's investment income on the parent's tax return, rather than on a separate tax. Web earning interest and dividends can result in your child needing to file a tax return for their investment income, however, and those amounts must be reported on internal revenue service (irs) form 8814, parent’s election to report child’s interest and dividends. From within your taxact return ( online or desktop), click federal. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates,. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form. Web whether or not you can use irs form 8814 to report your child’s total investment income when does it make. Form 8814, parents’ election to report child’s interest and dividends updated september 12, 2021 parents may elect to.

Form 8814 Edit, Fill, Sign Online Handypdf

Use this form if you elect to report your child’s income on your return. If you choose this election, your. A separate form 8814 must. It means that if your child has unearned income more than $2,200, some. Web this form is used to report the child's investment income on the parent's tax return, rather than on a separate tax.

Form 8814 Parents' Election To Report Child'S Interest And Dividends

Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form. If you do, your child. Web key takeaways parents use form 8814 to report a child’s income on their tax return, simplifying the tax filing. What is the form used for? From within your taxact return ( online or.

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Web key takeaways parents use form 8814 to report a child’s income on their tax return, simplifying the tax filing. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to.

8814 Fill Out and Sign Printable PDF Template signNow

Department of the treasury internal. Web part i child’s interest and dividends to report on your return. If you choose this election, your. If you do, your child. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return.

Generating Form 8814 in Lacerte

Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Web use this form if you elect to report your child’s income on your return. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Form 8814, parents’ election to report child’s.

Irs form 8814 instructions

Web use this form if you elect to report your child’s income on your return. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of. Web attach form(s) 8814 to your tax return and file your return by the due date (including extensions)..

8814 Form 2023

Department of the treasury internal. If you choose this election, your. If you choose this election, your. Use this form if the parent elects to report their. Form 8814, parents’ election to report child’s interest and dividends updated september 12, 2021 parents may elect to.

Form 8814 Instructions 2010

Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form. Web part i child’s interest and dividends to report on your return. Web to enter information for the parents' return (form 8814): Web purpose of form. Web form 8814 will be used if you elect to report your child’s.

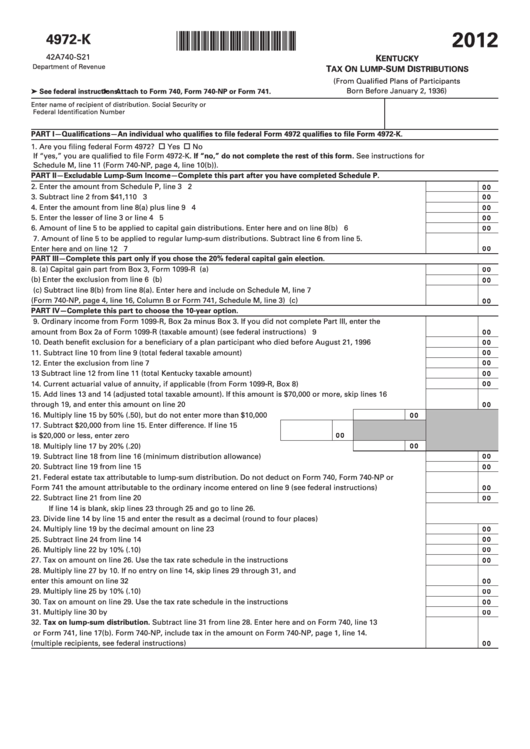

Fillable Form 4972K Kentucky Tax On LumpSum Distributions 2012

If you do, your child will not have to file a return. Web use this form if you elect to report your child’s income on your return. If you choose this election, your. Use this form if you elect to report your child’s income on your return. If you do, your child.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Web form 8814 department of the treasury internal revenue service (99) parents’ election to report child’s interest and. A separate form 8814 must. Web to enter information for the parents' return (form 8814): Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Web earning interest and dividends can result in.

If the child's interest and dividend income (including capital. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates,. If you choose this election, your. Web key takeaways parents use form 8814 to report a child’s income on their tax return, simplifying the tax filing. Web form 8814 department of the treasury internal revenue service (99) parents’ election to report child’s interest and. It means that if your child has unearned income more than $2,200, some. Web attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web earning interest and dividends can result in your child needing to file a tax return for their investment income, however, and those amounts must be reported on internal revenue service (irs) form 8814, parent’s election to report child’s interest and dividends. Web part i child’s interest and dividends to report on your return. If you do, your child. Use this form if you elect to report your child’s income on your return. Web use this form if you elect to report your child’s income on your return. Kiddie tax rules apply to unearned income that belongs to a child. If you do, your child will not have to file a return. Form 8814, parents’ election to report child’s interest and dividends updated september 12, 2021 parents may elect to. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of. If you choose this election, your. What is the form used for? Use this form if the parent elects to report their. Web purpose of form.

Web Earning Interest And Dividends Can Result In Your Child Needing To File A Tax Return For Their Investment Income, However, And Those Amounts Must Be Reported On Internal Revenue Service (Irs) Form 8814, Parent’s Election To Report Child’s Interest And Dividends.

Web this form is used to report the child's investment income on the parent's tax return, rather than on a separate tax. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form. Web part i child’s interest and dividends to report on your return. Web whether or not you can use irs form 8814 to report your child’s total investment income when does it make.

Web The Choice To File Form 8814 With The Parents' Return Or Form 8615 With The Child's Return Is One To Be Made By The Preparer Of.

Form 8814, parents’ election to report child’s interest and dividends updated september 12, 2021 parents may elect to. If you choose this election, your. Web attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web to enter information for the parents' return (form 8814):

What Is The Form Used For?

If you do, your child will not have to file a return. Web form 8814 will be used if you elect to report your child’s interest/dividend income on your tax return. Use this form if you elect to report your child’s income on your return. Web key takeaways parents use form 8814 to report a child’s income on their tax return, simplifying the tax filing.

If You Do, Your Child.

Web purpose of form. Kiddie tax rules apply to unearned income that belongs to a child. A separate form 8814 must. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return.